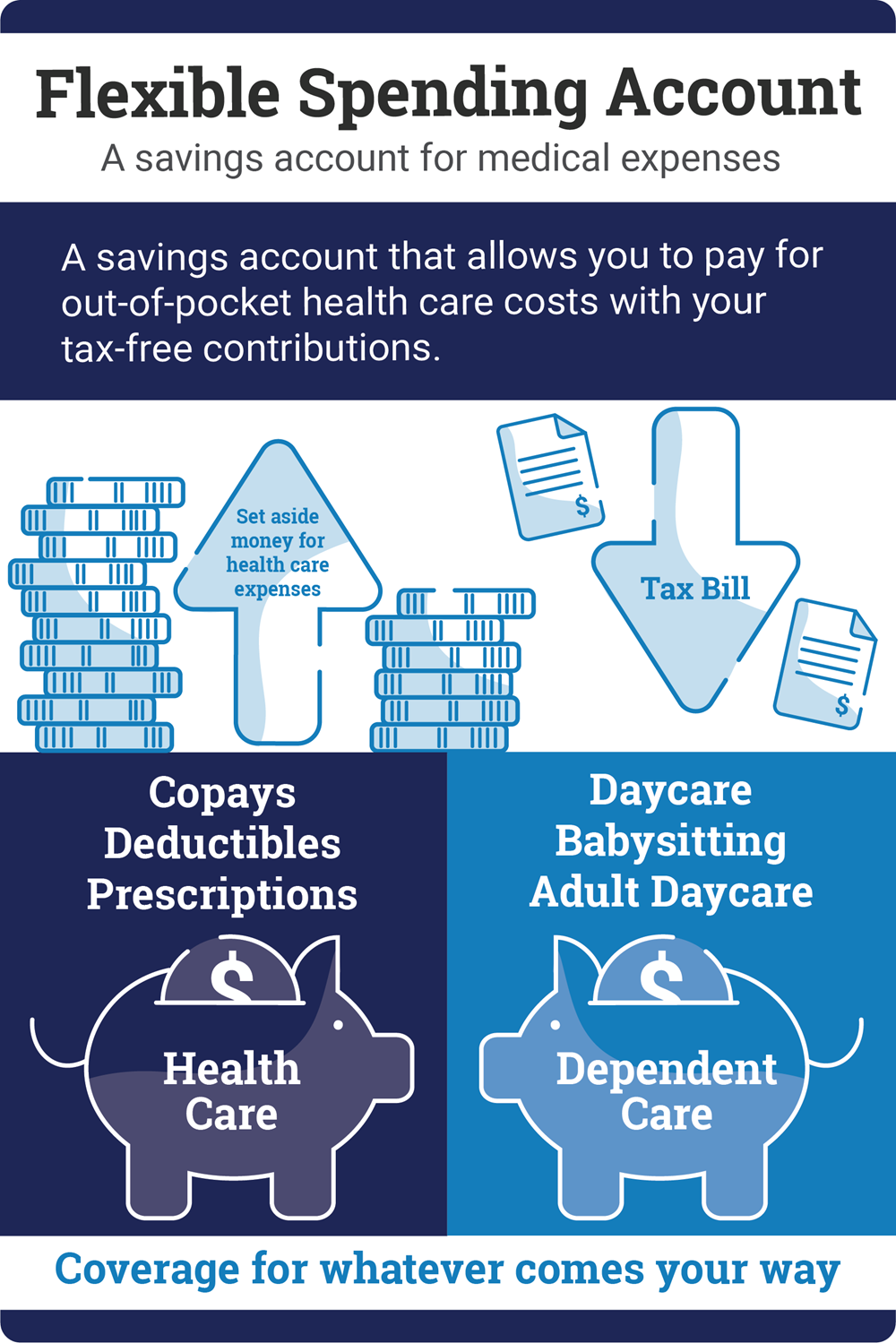

Flexible Spending Accounts (FSAs) enable you to put aside money for important expenses and help you reduce your income taxes at the same time.

The Health Care FSA is available to employees enrolled in the Aetna Best Choice EPO and Aetna Open Access Select EPO plans only.* The Dependent Care FSA has no medical plan restrictions.

Broward Health offers two types of Flexible Spending Accounts - a Health Care Flexible Spending Account and a Dependent Care Flexible Spending Account. These accounts allow you to set aside pre-tax dollars to pay for certain out-of-pocket health care or dependent care expenses.

Broward Health has partnered with WageWorks, a leading provider of consumer-directed benefits in the United States, as our trusted provider to administer the FSA process and offer our members enhanced benefit solutions. The WageWorks platform provides a variety of reimbursement options (which includes a Health Care debit card and the WageWorks EZ Receipts mobile app, an enhanced participant website with mobile access, and extended customer service hours). For questions/assistance, contact the WageWorks Customer Service Center at 1-877-924-3967.

For Dependent Care FSA guidelines, go to https://healthequity.com/learn/dcfsa.

You must actively re-enroll in either FSA plan each year.

You are not automatically re-enrolled.

How Flexible Spending Accounts Work

- Each year during enrollment, you will be required to enroll and decide how much to set aside annually for health care and/or dependent care expenses.

Your contributions are deducted from your paycheck on a pre-tax basis in equal installments

throughout the calendar year.

Debit cards will be issued to all employees enrolled in the Health Care Flexible Spending Account.

Employees enrolled in the Dependent Care Flexible Spending Account will need to submit claims for

reimbursement directly online to WageWorks.

You can only spend monies in the Dependent Care FSA that are in your available balance.

Please note that these accounts are separate - you may choose to participate in one, both, or neither. You cannot use money from the Health Care FSA to cover eligible expenses under the Dependent Care FSA or vice versa.

Plan carefully: This is a "use-it or lose-it" benefit with an annual roll-over of $500.

|

Plan |

Annual Maximum Contribution |

Examples of Covered Expenses |

|---|---|---|

Health Care Flexible Spending Account* |

$3,200 |

Copays, deductibles, orthodontia, over-the-counter medications, etc.** |

Dependent Care Flexible Spending Account |

$5,000 ($2,500 if married and filing separate tax returns) |

Day care, nursery school, elder care expenses, etc.** |

*If you are enrolled in the HDHP Plan, you are eligible to enroll in a Limited Purpose Health Care Flexible Spending Account. A Limited Purpose account can be used for dental and vision qualified expenses immediately, but not medical qualified expenses until your deductible is satisfied.

**See IRS Publications 502 and 503 for a complete list of covered expenses.