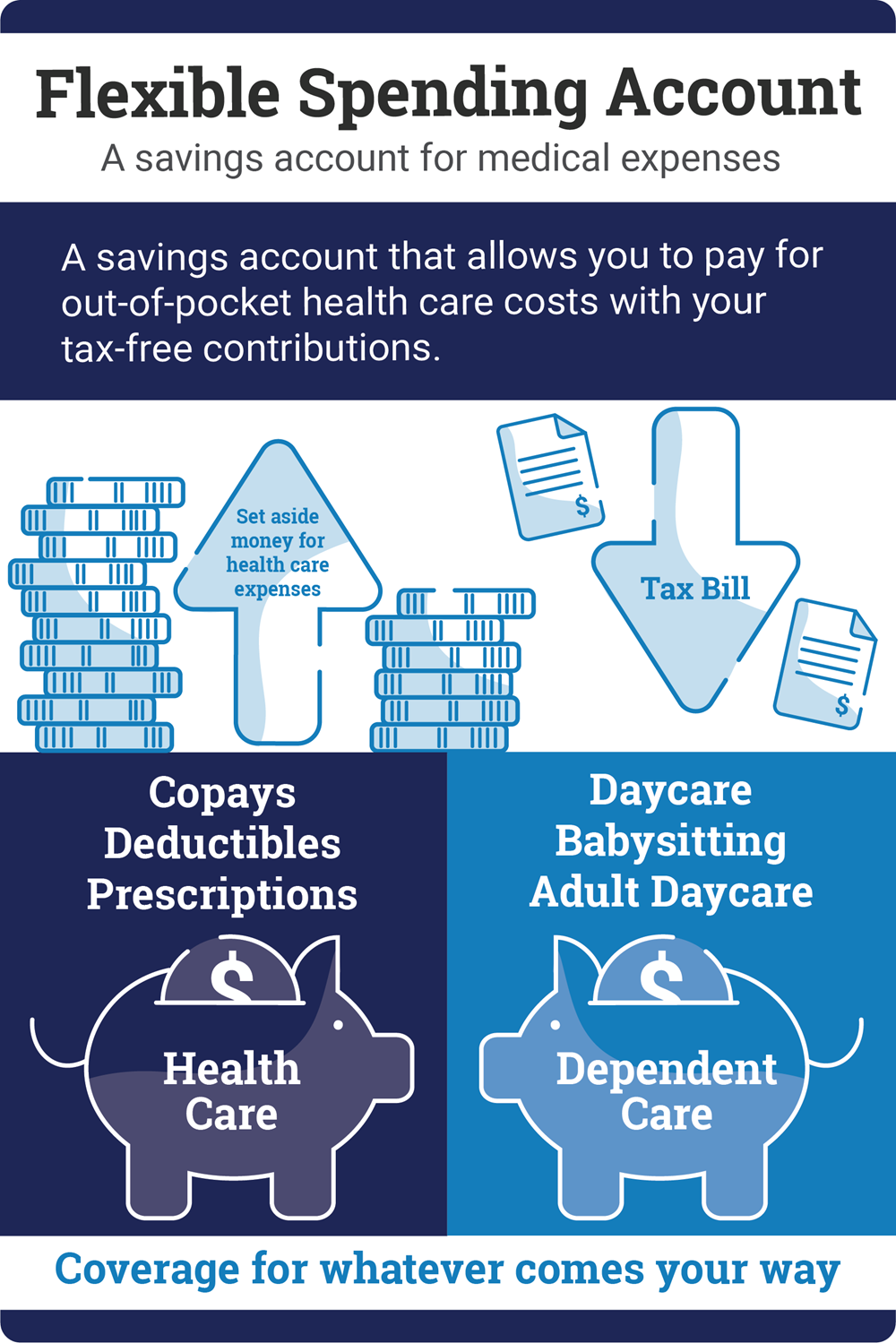

You Can Reduce Your Taxes By Putting Money Aside For Eligible Expenses

Flexible Spending Accounts (FSAs) allow you to put aside money for important expenses and help you reduce your income taxes at the same time. Catholic Health offers two types of accounts – a Health Care Flexible Spending Account and Child Care Pre-tax Savings Account.

How Flexible Spending Accounts Work

- You decide how much to set aside for FSA expenses. Your full contribution amount will be available for use on your benefit effective date.

- Your contributions are then deducted from your paycheck on a pre-tax basis in equal installments throughout the calendar year for use on qualified expenses.

- You can pay for eligible-expenses out-of-pocket and submit a claim form for reimbursement.

- Up to $640 of unused funds in your Health Care FSA may be rolled over for use in the next year. IRS requires that any unused money left in your account at the end of the year in excess of $640 be forfeited. Please note, this roll-over feature is not available for the Child Care Pre-tax Savings Account.

Health Care Flexible Spending Account

The Health Care Flexible Spending Account offers a real tax savings advantage for your pocketbook. Many people find it a cost effective way to pay for such items as medical and dental plan deductibles/co-payments, eyeglasses, contact lenses, orthodontics and other health related expenses that are not covered by insurance. Even taxpayers who do not itemize their expenses can take advantage of this tax break using the Health Care Flexible Spending Account. Expenses that are eligible for reimbursement include those incurred by you and your dependents.

The annual maximum Health Care FSA contribution for 2024 is $3,200 per participant.

Health Care Flexible Spending Account - Details

- IRS regulations state that expenses reimbursed under your Health Care Flexible Spending Account may not be reimbursed under any other plan or program. Only your out-of-pocket expenses are eligible.

- Up to $640 may be rolled over for use in the next year. IRS requires that any unused money left in your account at the end of the year in excess of $640 be forfeited.

- The amount you contribute to this account is not subject to federal, state, or Social Security (FICA) taxes.

- Allows you to pay for eligible medical, dental and prescription drugs expenses with pre-tax dollars.

- Annual election is deducted in even increments from each paycheck and contributed to your Health Care Flexible Spending Account.

- When a medical, dental, or prescription drug expense is incurred, the claim is automatically processed. Claims for other eligible expenses should be submitted manually. Please note: employees not enrolled in our medical, dental or prescription plan will have to submit their claims manually.

- Services must be incurred within the plan year and must be claimed by March 31 of the following year.

- Expenses reimbursed under a Health Care Flexible Spending Account may not be used to claim any federal income tax deduction or credit.

Child Care Pre-tax Savings Account

Extend your income by using the Child Care Pre-tax Savings Account to pay for work-related dependent care expenses with income tax-free dollars. You can save a significant amount of money by participating in this account. If you are paying for day care expenses now, you are paying with taxable dollars and probably taking the federal tax credit at the end of the year. If you use the Child Care Pre-tax Savings Account, you will pay these expenses with pre-tax dollars throughout the year, reducing the need to use the tax credit at the end of the year. In most instances, the savings realized through participation in the Child Care Pre-tax Savings Account will be greater than the savings available through the tax credit. The Child Care Pre-tax Savings Account is for childcare expenses or expenses related to care for a spouse or elderly parent who resides in your home.

This year, the annual maximum contribution for filing the Child Care Pre-tax Savings Account is $5,000. If you are filing separate tax returns, the FSA limit is $2,500.

- Claims for dependent children are covered up until their 13th birthday. Claims incurred after their 13th birthday are not eligible for reimbursement.

- Maximum annual contribution allowed by the IRS is $5,000.

- IRS requires that unused money left in your account at the end of the plan year be forfeited.

- The amount you contribute to this account is not subject to federal, state, or Social Security (FICA) taxes.

- Participation in this account will reduce or eliminate the ability to use the federal tax credit for dependent care.

- Must allow both you and your spouse to work.

- You must be able to provide tax ID number or Social Security number for the provider.

- Annual election is deducted in even increments from each paycheck and contributed to your Child Care Pre-tax Savings Account.

- Services must be incurred within the plan year.

- Dependent care claim forms must be submitted manually.

To view your account, register at www.myflexdollars.com.

These plans, as well as your entire health program, are intended and designed to be administered consistent with the tenets of the Catholic faith.

General Information

Who Should Enroll?

The Health Care Flexible Spending Account is beneficial for anyone who has medically necessary out-of-pocket medical, dental, vision or hearing expenses beyond what their insurance plan covers.

The Child Care Pre-tax Savings Account is generally beneficial to anyone who has a qualified dependent and eligible day-care expenses.

Who is a Qualified Dependent?

Generally, if a person qualifies as your eligible dependent for medical benefits, he/she qualifies as a dependent under the Health Care Flexible Spending Account.

(See Enrollment Eligibility page for a list of eligible dependents.)

Under the Child Care Pre-tax Savings Account, dependents are defined as children up until their 13th birthday or children 13 or over who are physically or mentally unable to care for themselves. A spouse or elderly parent residing in your home, who is physically or mentally unable to care for himself or herself, also qualifies.

Do I have to re-enroll during every open enrollment period?

Yes. The IRS requires that employees make new selections for each and every plan year. The process of enrolling is detailed in your enrollment materials. Regardless of the enrollment process adopted by your company, it is important to review your expenses each year to make sure that your selection is appropriate, based on the actual expenses you expect to have.

Transit and Parking Program

The Transit and Parking Program allows employees to pay, on a pre-tax basis, for the costs incurred for purposes of transportation between an employee’s home and place of employment. This does not include mileage, as it is not an eligible expense.

Enrollment can be done monthly or set up to be recurring.

Transit and Parking FSA accounts are for the employee’s use only. Expenses incurred by a spouse or dependent child are not eligible.

The transit and parking maximum pre-tax limits for 2024 are:

- Transit Limit: $315 per month

- Parking Limit: $315 per month

For more information, please review the Commuter Benefits Flyer.

How To Enroll

- Log on to www.myFlexDollars.com

- If you are registering as a new user, please use the initial login credentials below:

Username: First Initial + Last Name + Last 4 of SSN

Password: dollars

- Follow the steps in the document below called “Online Transit FSA Enrollment Steps”

- Enrollment by the 10th of the month will go into effect for the following month

How it works

- Designated pay period deductions go in your transit/ parking account each month.

- Money that is placed in your account is used to pay for qualifying transit and parking expenses.

- You may only be reimbursed up to your current account balance at any given time.

Reimbursement - Accessing Your Funds

Reimbursement For Transit Expenses

- Your Benny (debit card) is your key to transit expense reimbursement.

Please note that the Benny is the only method of reimbursement for transit expenses.

Reimbursement For Vanpooling Expenses

- Your Benny is the most convenient way to receive reimbursement for parking and vanpooling expenses.

- There is a second reimbursement method available for parking and vanpooling expenses - submitting a claim. You can submit a claim and itemized receipt/bill online at www.myFlexDollars.com, via the myFlexDollars app or by faxing it to the Employee Benefits Center at: 1-866-406-0946. You will be reimbursed via direct deposit or by check.

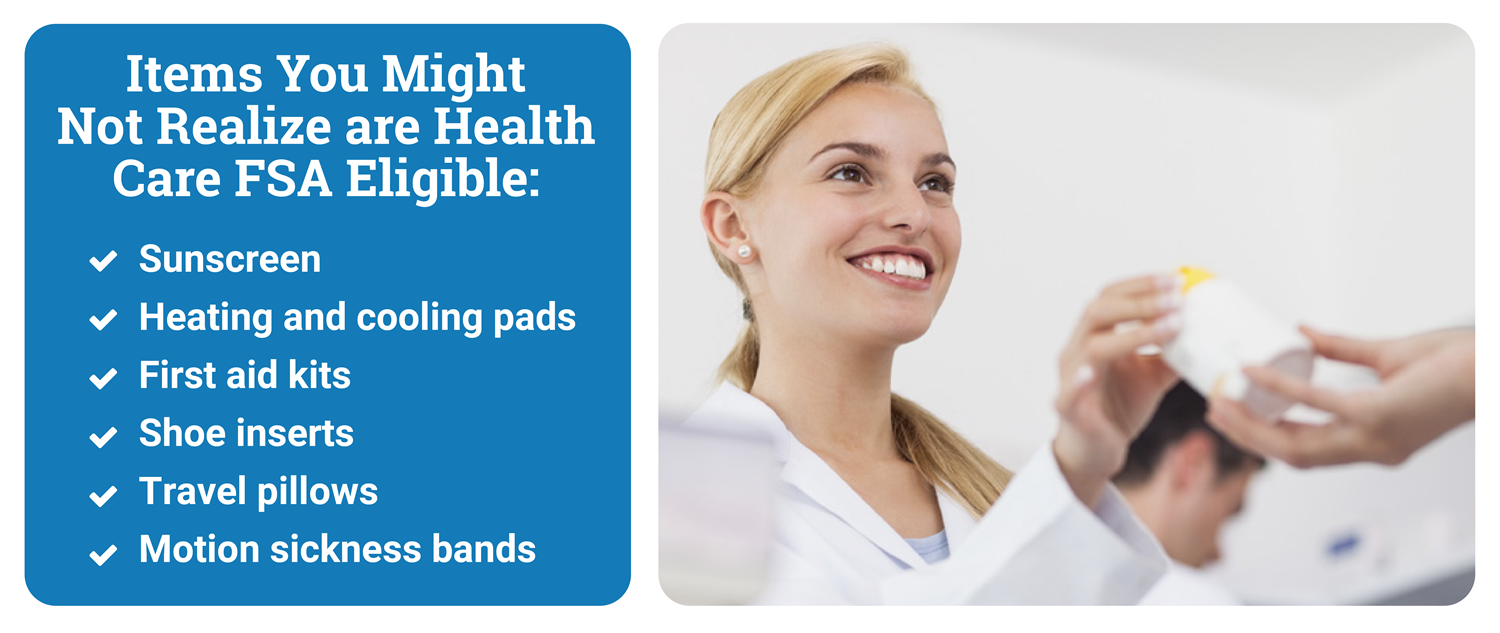

FSA Eligible and Ineligible Expenses

Health Care Flexible Spending Account

Eligible Expenses

- Acupuncture and chiropractic services

- Artificial limbs or teeth

- Childbirth classes

- Co-pays, co-insurance, and deductibles

- Crutches, wheelchairs, and other durable medical equipment

- Dental exams, cleanings, fillings, and other qualified services

- Eye exams and vision correction surgery

- Eyeglasses, contact lenses, and solutions

- Hearing devices

- Hospital bills

- Immunizations and flu shots

- Insulin, diabetic supplies and test kits

- Medical tests and other medical services

- Menstrual care products

- Orthodontia

- Over the Counter (OTC) drugs and medicines

- Physical exams and medical screenings

- Prescription drugs

- X-Rays

Ineligible Expenses

- Cosmetic dental procedures

- Cosmetic prescription drugs, surgery, and procedures

- Cosmetics, makeup, and perfume

- Cotton balls and swabs

- Deodorant, soap, shaving cream, and razors

- Diapers or diaper service

- Moisturizers and lotions

- Prescription drugs from another country

- Teeth whitening kits and strips

- Toothpaste, mouthwash, & antiseptics

- Birth control

- Contraceptives

- In-vitro fertilization

- Abortions

- Vasectomies

- Sterilization

Child Care Pre-tax Savings Account

Eligible Expenses

- Child care at a day camp or nursery school, preschool or by a private sitter (excludes transportation, lunches, educational services)

- Elder care for an incapacitated adult who lives with you at least eight hours per day

- Before-care and after-school childcare. These expenses must be kept separate from any tuition expense

- Local day camp

- Cost of a housekeeper whose duties include the care of a qualifying dependent

Ineligible Expenses

- Expenses for overnight camps

- Expenses for education or tuition

- Placement fees for finding a day-care provider (e.g. an au pair)

- Sports lessons, field trips, clothing or transportation

As you are aware, this plan as well as your entire health program is intended and designed to be administered consistent with the tenets of the Catholic faith. Therefore, those products or services that an individual may receive that are not consistent with tenets of the faith will not be eligible for reimbursements through this plan. Examples of some items that are not eligible for reimbursement include birth control, contraceptives, in-vitro fertilization, abortions, vasectomies, and sterilization procedures.

If I have more questions...

To get answers to other questions, please visit www.myflexdollars.com or call Baker Tilly at 800-307-0230, Prompt 9.

To view your account, register at www.myflexdollars.com. Neither your employer nor Baker Tilly provides tax or legal advice. Always ask your attorney or tax advisor for the appropriate tax advice for your situation.

Documents & Forms