MetLife Critical Illness coverage can help you protect yourself from the unexpected costs of a serious illness.

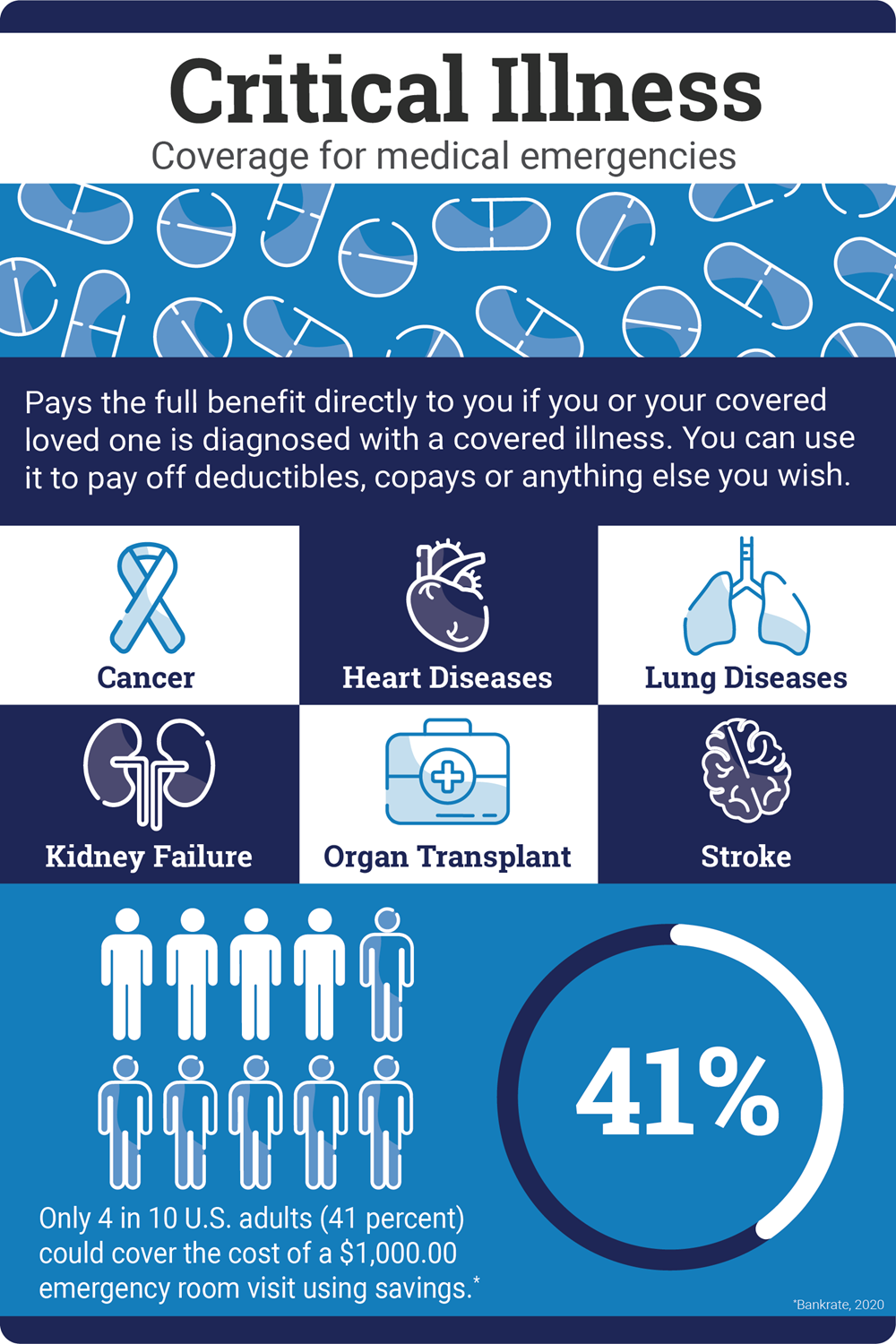

The out-of-pocket costs of a serious illness can take a toll on your finances, even with medical insurance. Critical Illness Insurance helps provide financial protection in the event of a covered serious illness or cancer*. The policy pays a lump sum benefit directly to you if you or a covered family member is diagnosed with a covered condition. You can use this benefit any way you choose – deductibles and coinsurance, expenses your family incurs to be by your side, or simply to replace your lost earnings from being out of work. You choose the benefit amount when you enroll.

Employees can enroll in the Voluntary Benefits when they are newly eligible or during Annual Open Enrollment. Employees will not be able to make mid-year changes to Voluntary Benefits.

Employees must be actively at work on the effective date in order to enroll in Critical Illness insurance.

Examples of covered illnesses may include:

- Heart attack

- Major organ transplant

- End stage renal (kidney) failure

- Invasive Cancer

- Stroke

- Alzheimer’s Disease

- Coronary Artery Bypass

Plan Features:

- You do not have to be terminally ill to receive benefits.

- Coverage options are available for your spouse and children.

- Employee coverage pays a lump-sum benefit of $10,000 - $40,000; available in $10,000 increments.

- Coverage is portable, which means you can take your policy with you if you change jobs or retire.

Documents & Forms

The policies have exclusions and limitations which may affect any benefits payable. See a complete list of covered conditions, along with complete provisions, exclusions and limitations.

*Please review the Disclosure Statement or Outline of Coverage/Disclosure Document for specific information about cancer benefits. Not all types of cancer are covered. Some cancers are covered at less than the Initial Benefit Amount. For NH-sitused cases and NH residents, there is an initial benefit of $100 for All Other Cancer.