Receive payments to help cover the cost of a hospital stay through MetLife.

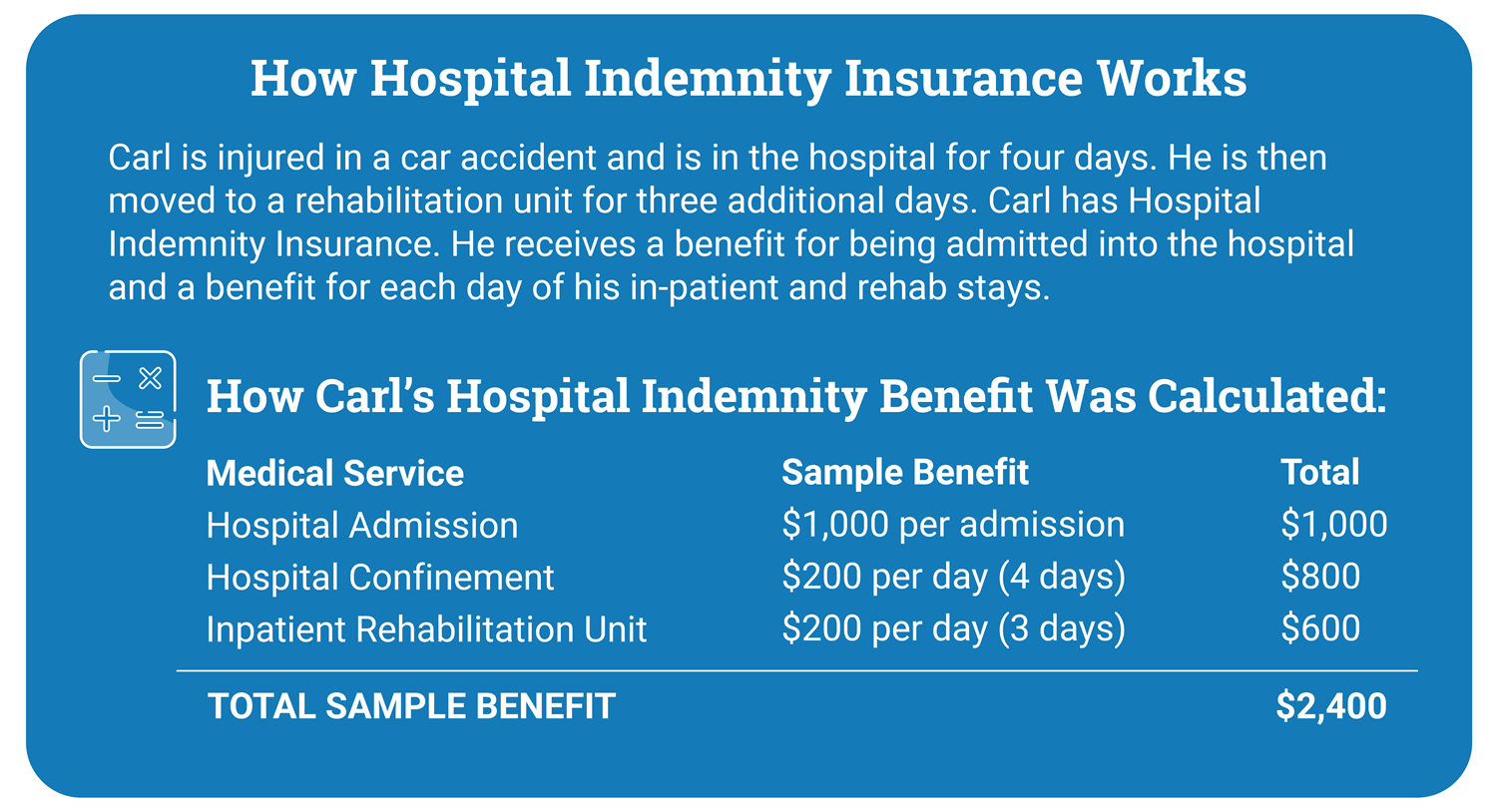

Even with medical insurance, a hospital stay can jeopardize your regular income and challenge your ability to cover everyday living expenses. MetLife Hospital Indemnity Insurance provides payments, in addition to your medical plan, to help cover eligible expenses associated with a hospital stay. Benefits are paid directly to you, and you can use the money however you choose. Benefits are designed to help offset expenses your medical plan doesn’t cover, such as deductibles, coinsurance and everyday bills.

Employees can enroll in the Voluntary Benefits when they are newly eligible or during Annual Open Enrollment. Employees will not be able to make mid-year changes to Voluntary Benefits.

Plan Features

- Benefits are paid regardless of any other insurance you have.

- No physical exams are required to enroll for coverage.

- Coverage is available for your spouse and children.

- Premiums are paid through convenient payroll deductions.

Additional plan details and rates will be provided during your enrollment session.

Documents & Forms

The policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations that may affect any benefits payable.

When completing the Claim Form, you will need your Certificate Number, which can be found on your Certificate of Coverage. You can obtain a copy of your Certificate of Coverage on MetLife’s member portal – MyBenefits (metlife.com/mybenefits).