Always be there financially for your loved ones.

Your family depends on your income for a comfortable lifestyle and for the resources necessary to make their dreams – such as a college education – a reality. Like anyone, you don’t like to think of the scenario where you’re no longer there for your family. However, you do need to ensure their lives and dreams can continue if the worst does happen.

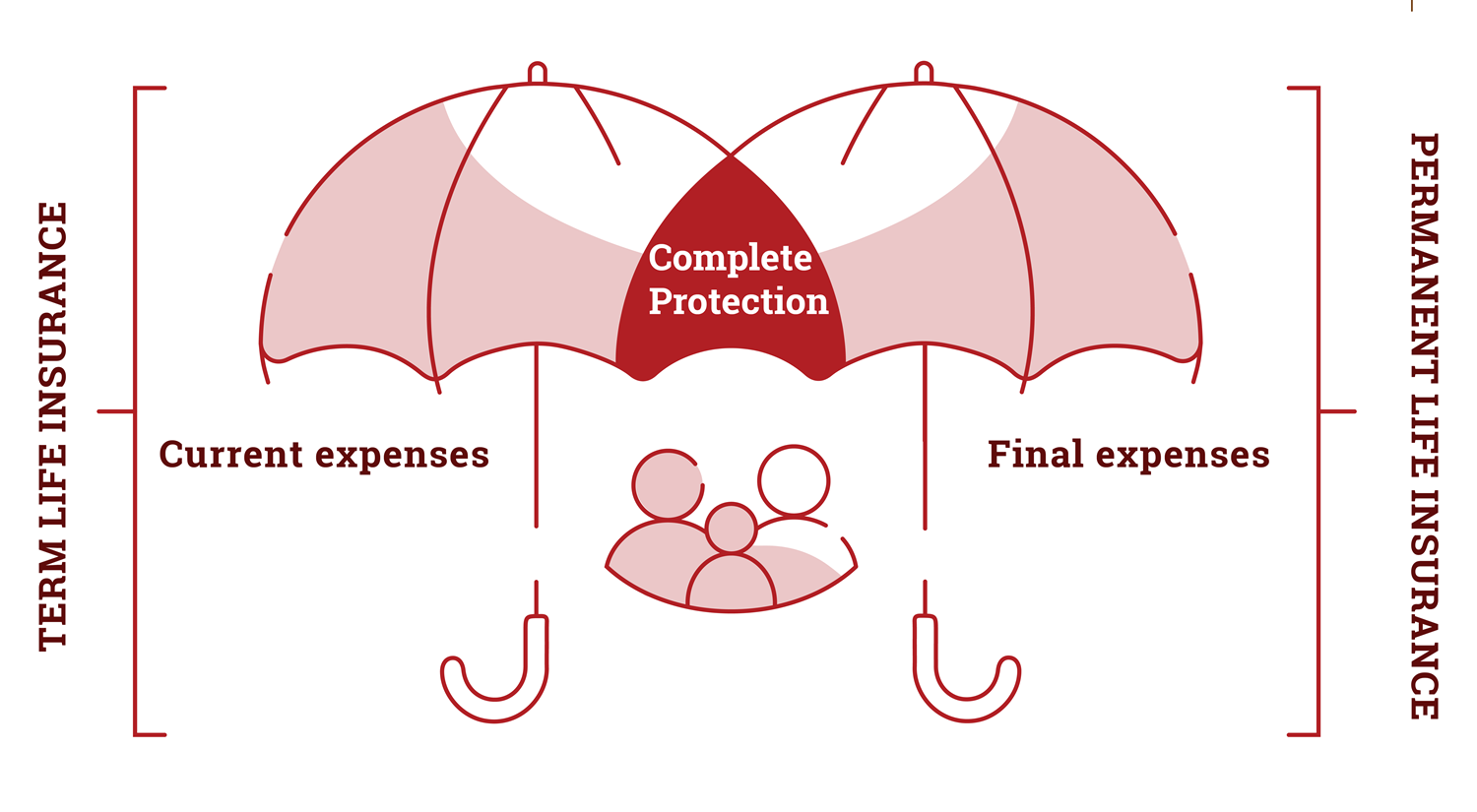

Moog knows how difficult it can be to provide this peace of mind on your own, which is why we have made it a priority to give you the ability to assemble a complete life insurance portfolio.

Basic Term Life and Accidental Death and Dismemberment Insurance

Moog provides eligible employees with basic term life and accidental death and dismemberment coverage at no cost to you and enrollment is automatic.

Basic Term Life

The benefit is equal to a multiple of your annual salary.

Accidental Death and Dismemberment

If you are seriously injured or lose your life in an accident, you will be eligible for a benefit equal to your basic term life coverage.

Supplemental Life Insurance

Supplemental Term Life Insurance is the most affordable way to protect your family’s financial security if something happens to you. It replaces your income in the event of your death, and ensures that the ones who depend on you can support themselves financially in your absence.

Advantages Include:

- Help provide for a family’s loss of income

- Cover short-term debts and needs

- Provide additional insurance protection during the child-raising years

- Provide longer term protection to help your family pay off a mortgage or to help pay for a college education

You can purchase life insurance for your eligible dependents as well. The cost for Spouse Life Insurance is based on the level of coverage you choose. For Child Life Insurance, the cost is also based on the level you choose; however, the cost is the same no matter how many children you are covering.

Plan Features:

- You have the ability to purchase life insurance for yourself, your spouse, your children, and/or any other eligible dependents.

- Supplemental Term Life Insurance, which means you purchase the precise amount of coverage that is right for your needs.

- No physical exams are required to apply for coverage (although health questions may be asked).

- Coverage is portable — you can take your policy with you if you leave the company and carry your life insurance coverage into your retirement.

- Your Benefits Counselor can help you calculate the cost of the benefit, which will vary depending upon your age, the amount of coverage you elect, or dependent coverage you choose, and other such factors.

How Much Life Insurance Do You Need?

Many financial experts recommend you have at least five to eight times your household income in life insurance. To calculate the level sufficient to cover your needs, you should consider your current income and how much it costs to maintain your family’s standard of living.

Whole Life Insurance*

Whole Life Insurance completes your family’s protection, providing a cost-effective benefit for final expenses such as funeral costs, credit card debt, and medical bills. As long as premiums are paid, this policy will not expire, and premiums will not change due to your age.

The premium cost for this benefit is determined by your age and the amount of coverage you elect. Locking in a lower premium now will help you save money in the future.

*Only offered during Open Enrollment.