Receive payments to help cover the cost of a hospital stay.

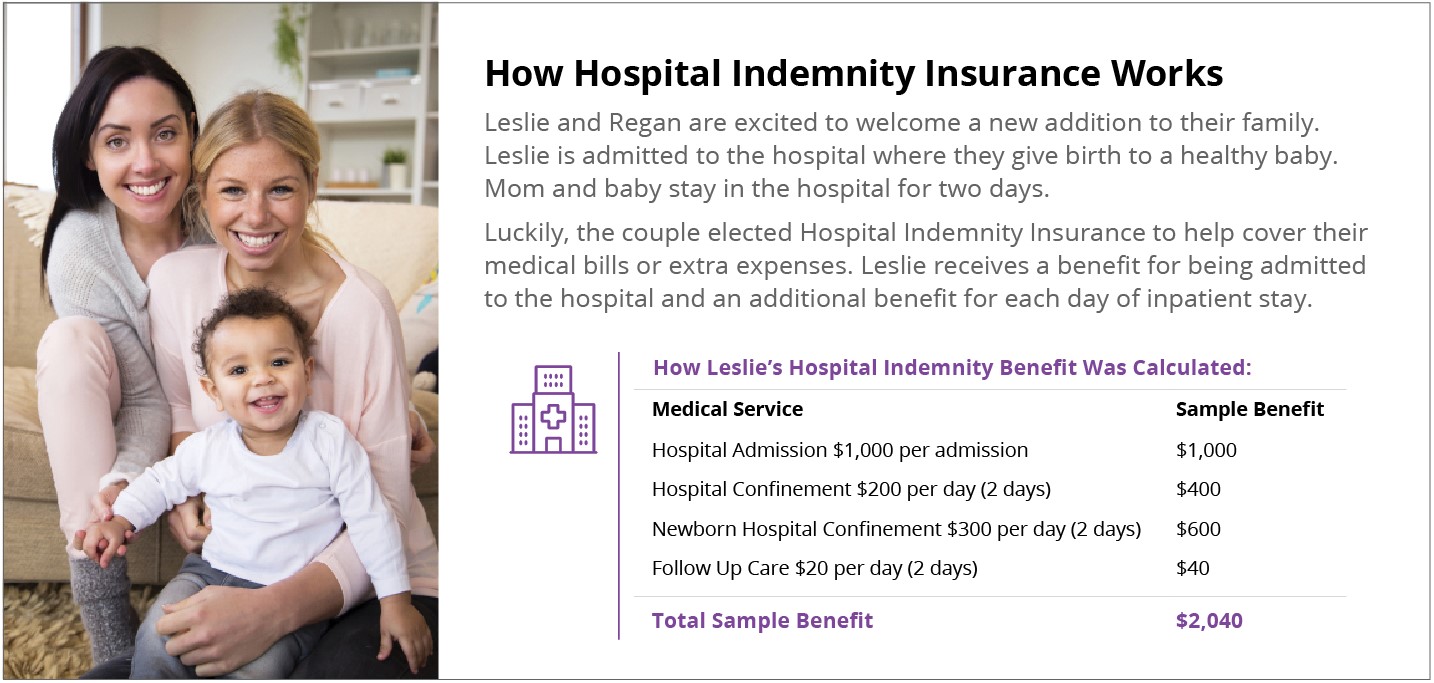

If you are admitted into a hospital, it doesn’t take long for the out-of-pocket costs to add up. Hospital Indemnity Insurance pays benefits directly to you if you are admitted into a hospital for care including childbirth. Benefits are paid even if you have other coverage.

You receive a benefit as soon as you are admitted and then an additional benefit based on the number of days you are confined to the hospital. The benefit increases if you are admitted and confined to an intensive care unit or inpatient rehabilitation.

For more information contact Aetna at 1-800-998-3797 (TTY: 711). To file a claim visit, myaetnasupplemental.com.

Plan Features

- Guaranteed Acceptance: There are no health questions or physical exams required.

- Family Coverage: You can elect to cover your spouse and children.*

- Maternity Coverage: If you or a covered dependent are expecting when you enroll, childbirth will be covered after the effective date.

- Portable Coverage: You can take your policy with you at individual rates if you leave Parker.

- Wellness Benefit: The plan provides a $75 benefit per covered person per calendar year if you and/or your covered dependents complete a covered wellness health screening test such as a biometric screening, physical exam, total cholesterol blood test, mammogram, and more. This screening must take place after your coverage effective date during the plan year.

Access the plan summary below to learn more:

*If you elect coverage for your dependent children, you must provide notification to your employer when all of your dependent children exceed the dependent child age limit or no longer otherwise meet the definition of a dependent child.

If you elect coverage for your spouse, you must provide notification to your employer if your spouse no longer meets the definition of a spouse.

This plan is not a replacement for medical insurance.