You can protect yourself from the unexpected costs of a serious illness.

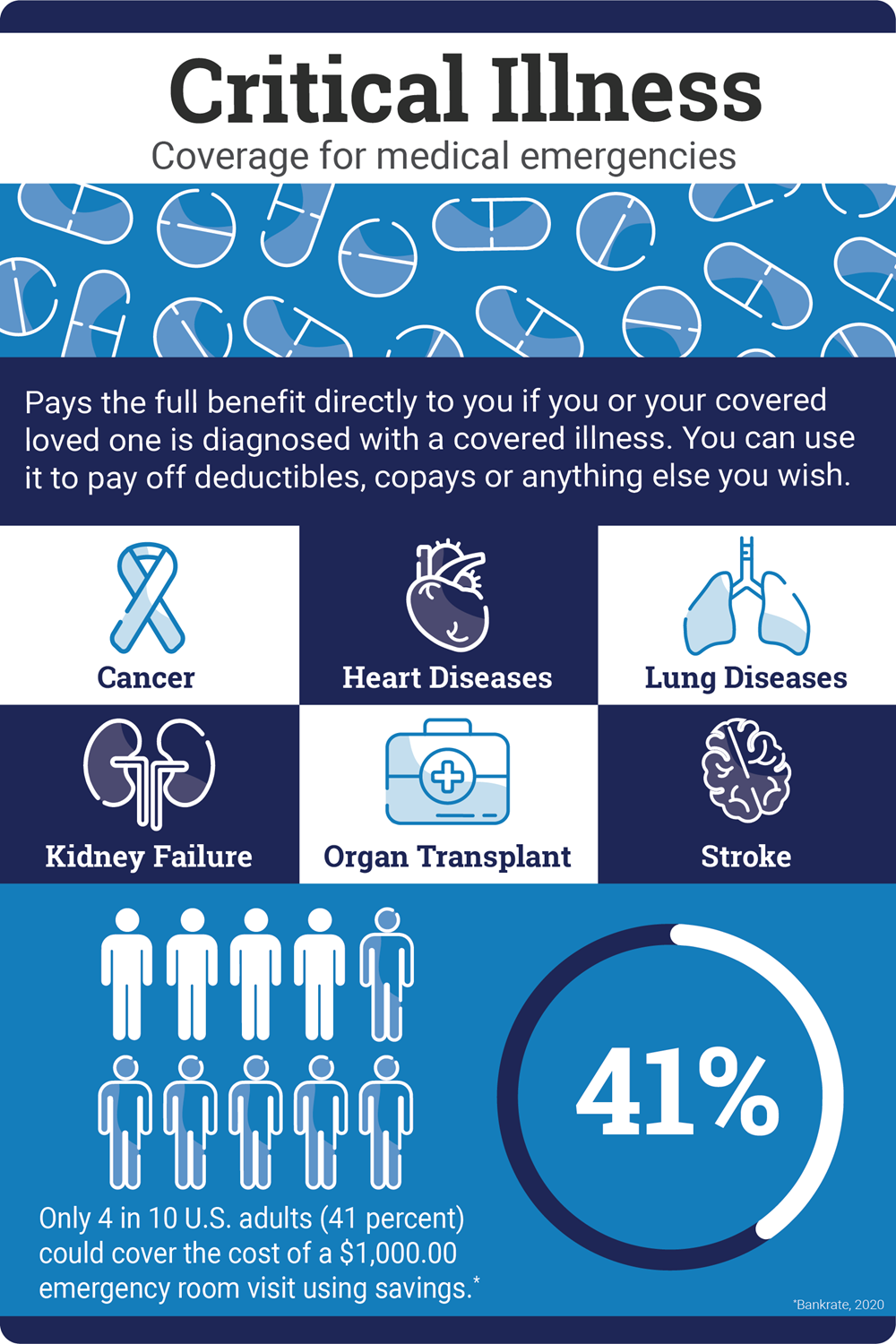

Even the most generous medical plan does not cover all of the expenses of a serious medical condition like a heart attack or cancer. Critical Illness Insurance pays a full lump sum benefit directly to you if you are diagnosed with a covered illness that meets the plan criteria. The benefit is paid in addition to any other insurance coverage you may have.

Please note: This plan is not a replacement for medical insurance.

Choose the benefit amount right for you:

- $5,000

- $10,000

- $15,000

- $20,000

- $25,000

- $30,000

NOTE: Spouse and children will be insured for 50% of your amount.

Note: If you elect coverage for your dependent children, you must provide notification to your employer when all of your dependent children exceed the dependent child age limit or no longer otherwise meet the definition of a dependent child. If you elect coverage for your spouse, you must provide notification to your employer if your spouse no longer meets the definition of a spouse.

Covered Illnesses*

- Heart Attack

- Stroke

- Cancer

- Major Organ Failure

- End Stage Renal (Kidney) Failure

*The policies/certificates of coverage or their provisions, as well as covered illnesses, may vary or be unavailable in some states for supplemental medical benefits. The policies/certificates of coverage have exclusions and limitations which may affect any benefits payable.

Plan Features

- Guaranteed Acceptance: There are no health questions or physical exams required.

- Family Coverage: You can elect to cover your spouse and children.

- Portable Coverage: You can take your policy with you if you change jobs or retire.

- Health Screening Benefit: The plan provides a $100 benefit per covered person per calendar year if you or your covered dependents complete a covered health screening test such as biometrics or breast cancer screening.

This scenario does not reflect the benefits of a specific Critical Illness Insurance plan schedule. The benefits are generic benefits for the purposes of this example to show how the benefit total of a Critical Illness Insurance plan is calculated. The plan offered to you may provide different benefit amounts and may not cover all services. See the plan details for the benefit schedule for the plan offered to you.