Always be there financially for your loved ones.

SRA automatically provides several income protection benefits at no cost to eligible employees and their family members with the opportunity to elect plans for additional security. The plans protect your finances, and secure a comfortable future by paying benefits directly to you, or to your beneficiaries. Click on the topics below to learn more.

Basic Life Insurance

- Employee: Benefit amount equal to two times (2X) your annual base salary, to a maximum of $500,000

- Spouse: $10,000 benefit amount

- Child(ren): $5,000 ($500 birth to six months) benefit amount

You are automatically enrolled, and the coverage is provided at no cost to you.

Supplemental Term Life Insurance

- Employee: Up to eight times (8X) your annual salary. The maximum benefit amount is $1.5 million.

- Spouse: If you elect supplemental life for yourself, you can also purchase additional life insurance for your spouse. You may elect up to $150,000 in $10,000 increments.

- Child: If you elect supplemental life for yourself, you can purchase additional life insurance for your child(ren) in the amount of $5,000 or $10,000 ($500 birth to six months).

Basic Accidental Death & Dismemberment (AD&D)

Benefit amount equal to two times (2X) your annual average salary, to a maximum of $500,000. You are automatically enrolled and the coverage is provided at no cost to you.

Supplemental Accidental Death & Dismemberment (AD&D) Insurance

- Employee: Up to eight times (8X) your basic annual earnings, to a maximum of $1,500,000.

- Families: Spouses covered at 50% of your coverage amount and your child(ren) covered at 10% of your coverage amount.

- Spouse, no child(ren): Your spouse covered at 60% of your coverage amount.

- Child(ren), no spouse: Your child(ren) covered at 15% of your coverage amount.

Permanent Life Insurance

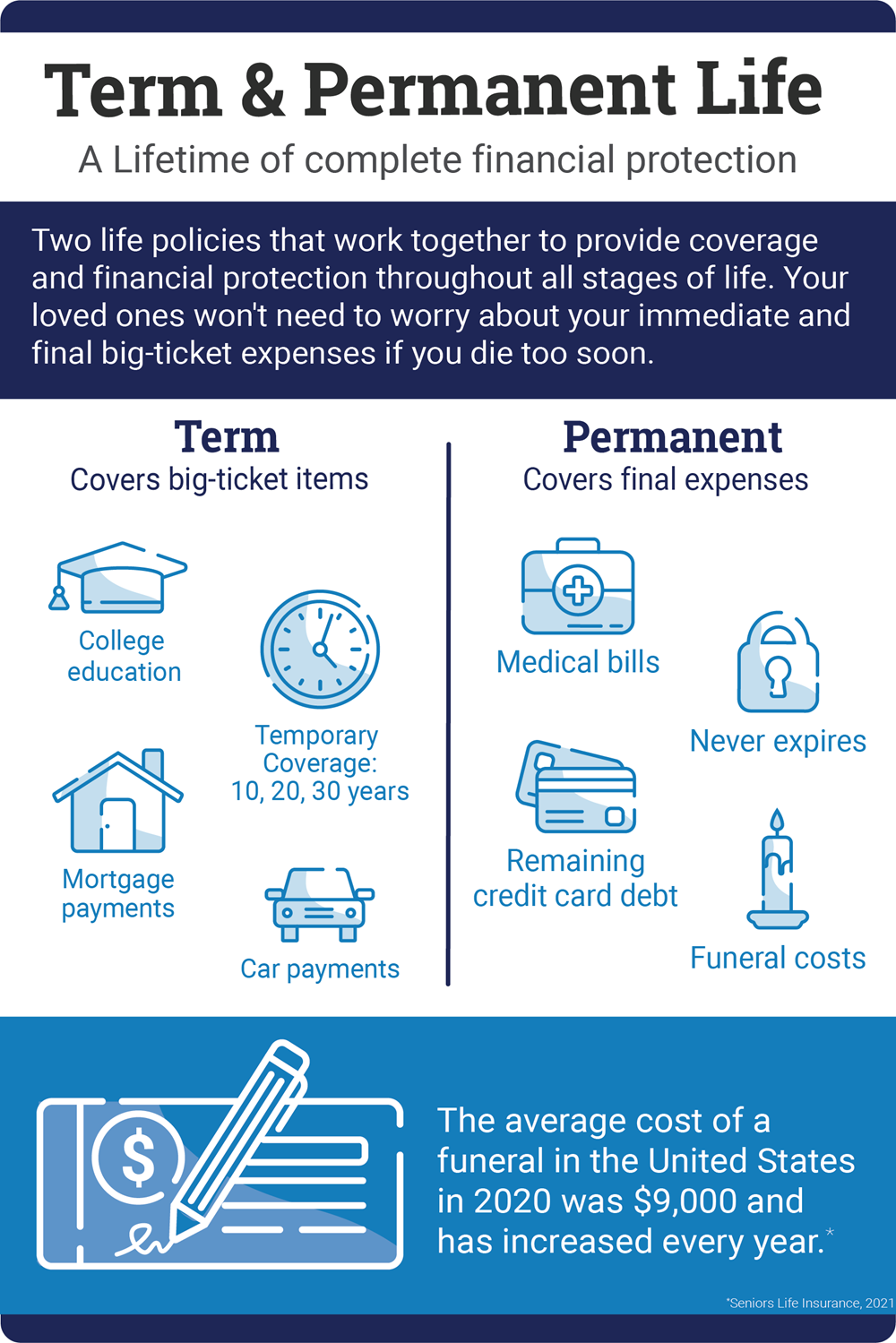

Chubb Lifetime Benefit Term Permanent Life Insurance can help to protect your family’s quality of life – after you’re gone or while you’re still living.

What makes LifeTime Insurance with Long-Term Care Benefits different?

- Permanent Coverage: As long as the premium payments are maintained, the policy never expires, and the premium always remains the same. Lock in a lower premium now to help you save money in the future. Premiums will never increase and are guaranteed through age 100. After age 100, no premium is due.

- Living Benefits: The Accelerated Death Benefit (ADB) for Terminal Illness Rider is an added feature to help if you are diagnosed with a terminal illness. There is also a child(ren) term rider which covers all dependent children.

- LTC Benefits: Includes Accelerated Death Benefits for Long Term Care (LTC). If you need LTC, Death benefits can be paid early for home health care, assisted living, adult day care and nursing home care.*

*The benefit is equal to the greater of 4% of your death benefit per month or $50 per day while you are living for up to 25 months. Premiums are waived while this benefit is being paid.

Additional Plan Features

- Guaranteed Acceptance: No physical exams or health questions are required for newly eligible employees to apply for coverage.

- Coverage Options: You can purchase coverage for yourself and your spouse that includes the accelerated benefit for chronic conditions.

• Employee: $10,000 – $100,000 benefit

• Spouse: $10,000 – $30,000 benefit

- Paid-Up Benefits: After 10 years, paid-up benefits begin to accrue. At any point thereafter, if an you decide to stop paying the premium, a reduced paid-up benefit is issued and can never lapse. That means an when you retire, you can stop paying the premium and have a death benefit for the rest of your life - guaranteed.

- Portable Coverage: You can take this coverage with you if you change jobs or retire.

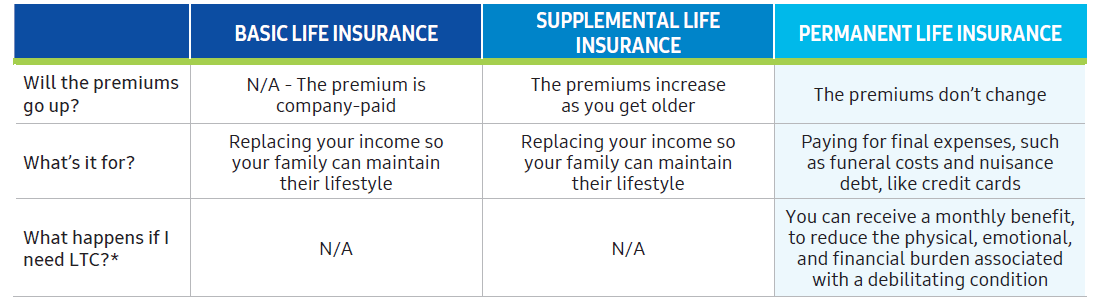

Life Insurance Plan Comparison

*The benefit is equal to the greater of 4% of your death benefit per month or $50 per day while you are living for up to 25 months. Premiums are waived while this benefit is being paid.

These policies or their provisions may vary or be unavailable in some states. The policies have exclusions and limitations which may affect any benefits payable.

* U.S. Department of Health and Human Services, How Much Care Will You Need, July 2020