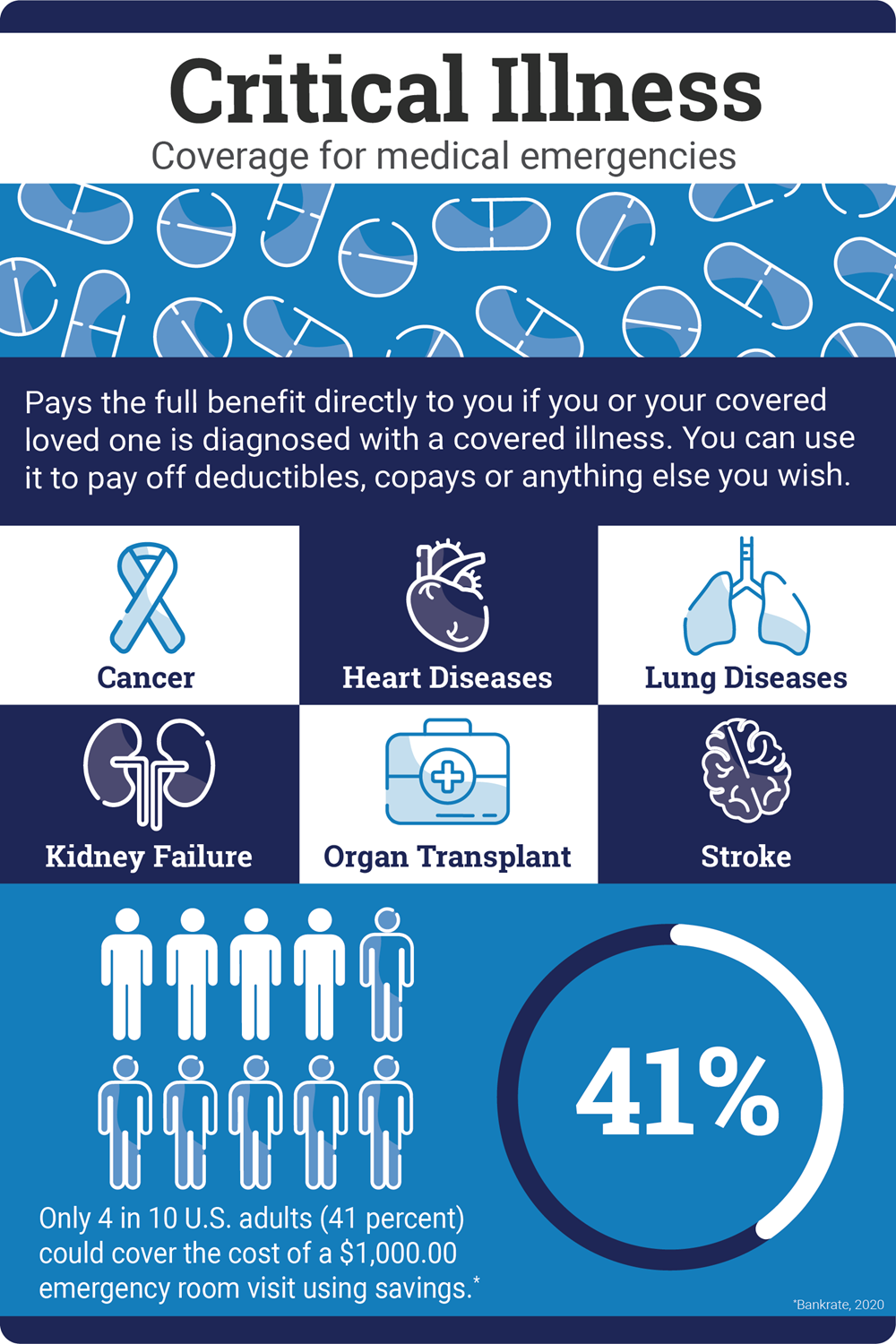

You can protect yourself from the unexpected costs of a serious illness.

Critical Illness Insurance pays a lump sum benefit directly to you if you are diagnosed with a covered illness that meets the plan criteria. The benefit is paid in addition to any other insurance coverage you may have. This plan is not a replacement for medical insurance.

Examples of Covered Illnesses

- Heart attack

- Stroke

- Cancer

Use This Benefit Any Way You Choose

- Pay for deductibles and coinsurance

- Replace earnings from being out of work

Coverage Amounts

If you are enrolled in the HSA Plan:

- A coverage amount of $5,000 is automatically provided to you.

- You also have the option to purchase a higher level of coverage.

If you are electing coverage on a voluntary basis, the following benefit amounts are available:

- Employee: $10,000 – $30,000

- Spouse: Automatically covered at 50% of your coverage level at no additional cost*

- Children: Automatically covered at 25% of your coverage level**

This policy is not a replacement for medical insurance.

These policies or their provisions may vary or be unavailable in some states. The policies have exclusions and limitations which may affect any benefits payable.

*If you elect coverage for your spouse, you must provide notification to your employer if your spouse no longer meets the definition of a spouse.

**If you elect coverage for your dependent children, you must provide notification to your employer when all of your dependent children exceed the dependent child age limit or no longer meet the definition of a dependent child.