You can protect yourself from the unexpected costs of a serious illness.

Even the most generous medical plan doesn’t cover all of the expenses of a serious medical condition like a heart attack or cancer. Critical Illness Insurance pays a full lump sum benefit directly to you if you are diagnosed with a covered illness. The benefit is paid in addition to any other insurance coverage you may have. You can choose to elect $10,000, $20,000, $30,000 or $40,000 in coverage.

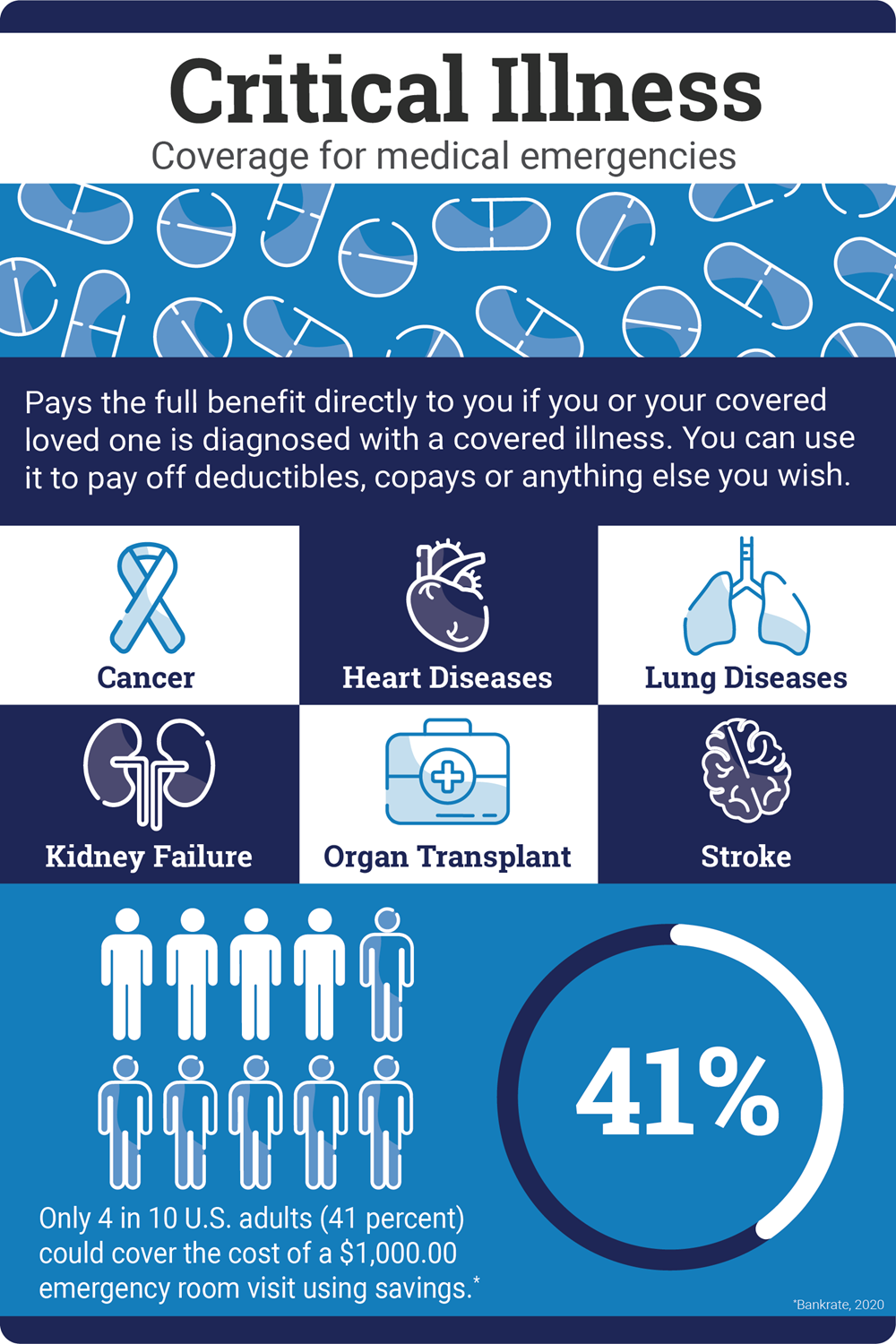

Covered Illnesses

- Heart Attack

- Stroke

- Cancer

- End Stage Renal (Kidney) Failure

- Major Organ Transplant

- Parkinson's Disease

- Alzheimer's Disease

- COVID-19*

The policies/certificates of coverage or their provisions, as well as covered illnesses, may vary or be unavailable in some states for supplemental medical benefits. The policies/certificates of coverage have exclusions and limitations which may affect any benefits payable.

*The coverage pays 25% of the face amount of the policy once per lifetime for COVID-19.

Plan Features

- Guaranteed Issue - There are no health questions or physical exams required.

- Family Coverage - Spouse and children can elect 50% of the employee selection.*

- Portable Coverage - You can take your policy with you if you change jobs or retire.

- Health Screening Benefit - Provides a $100 benefit per covered person per calendar year if you or your covered dependents complete a covered health screening test such as a physical exam, total cholesterol blood test, mammogram, lipid panel, COVID immunization and more.

This plan is not a replacement for medical insurance.

*If you elect coverage for your dependent children, you must provide notification to your employer when all of your dependent children exceed the dependent child age limit or no longer otherwise meet the definition of a dependent child. If you elect coverage for your spouse, you must provide notification to your employer if your spouse no longer meets the definition of a spouse.

Can I make changes to my Critical Illness coverage any time during the year?

Critical Illness can be canceled at any time. However, to add or make other changes to your coverage during the year outside of Open Enrollment you need to have a Qualifying Life Event.

Visit Workday Help to learn more about Qualifying Life Events and how to submit a request.

How do I file a claim?

Visit MyCigna.com, download the Mobile App, call 1-800-754-3207 Monday - Friday 8:00 am - 8:00 pm ET, or email SuppHealthClaims@Cigna.com to initiate your claim. To file a claim for your Health Screening Benefit you will need to provide the date of service, type of visit, name of doctor, location address, and phone number.

Critical Illness Benefit Summary