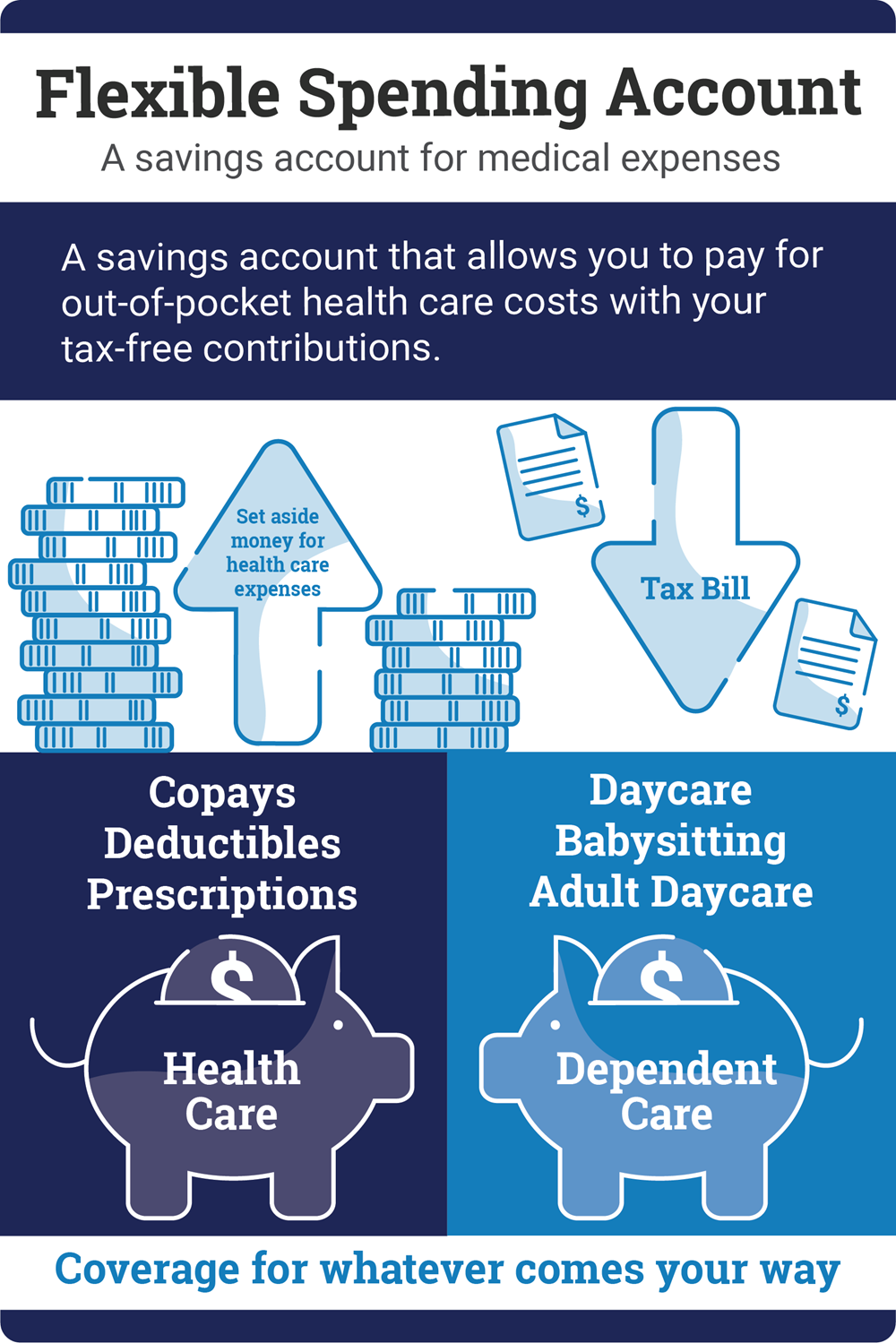

Reduce your income taxes while putting aside money for health and dependent care needs.

Corewell Health can help you create accounts to pay for eligible medical or daycare expenses. You fund Flexible Spending Accounts (FSAs) by setting aside part of your pay —before taxes— through payroll deduction. If you can estimate your expenses for the coming year, this can be a good way to save on your taxes each year.

You Can Elect Two Kinds of FSAs:

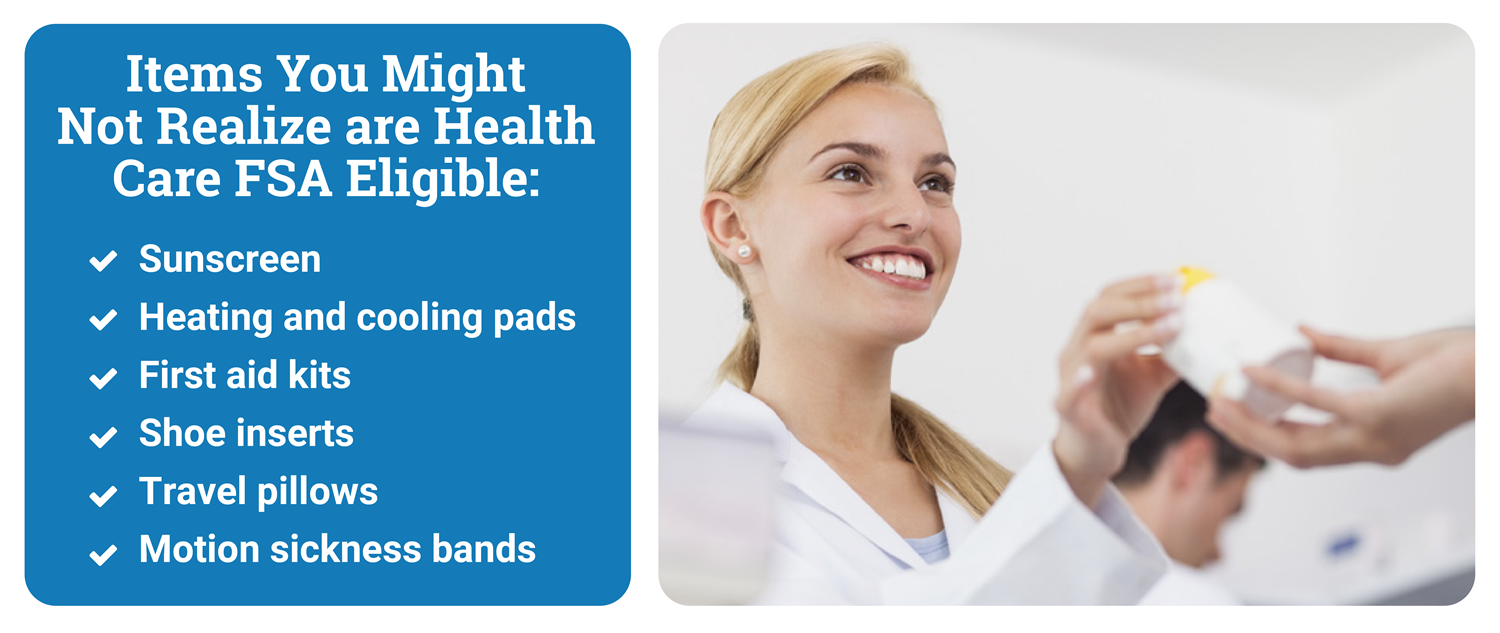

Health Care FSA

Eligible Expenses: If you are enrolled in the HMO Plan, you can use your Health Care FSA funds to pay for eligible medical, prescription drug, dental and vision expenses.

Eligibility: If you have an HSA through the HSA/POS Plan, a Health Care FSA is limited to eligible dental and vision expenses only. You would use your HSA for medical expenses.

Funding the FSA: You can contribute up to $3,200, unless regulations limit you to a smaller amount, per year, per household. Your funds are available only after they have been deposited each pay period.

Unused Funds: Unused funds in your account do not carry over at the end of the plan year and are lost.

Daycare/Dependent Care FSA

Eligible Expenses: Use this FSA to pay for eligible child or elder day care expenses for eligible dependents that allow you or your spouse to work or attend school full time. Dependent medical, dental and vision expenses are not eligible for reimbursement.

Eligibility: The Dependent Care FSA is available to benefits eligible team members regardless of medical plan enrollment.

Funding the FSA: You can contribute up to $5,000, unless regulations limit you to a smaller amount, per year, per household. Your funds are available only after they have been deposited each pay period.

If your annual base salary is $130,000 or greater you will be limited to a maximum annual election of $1,400. This limit is in place to insure that Corewell Health will not need to lower your contribution in the middle of the year when the IRS testing is not passed, see notes below on the testing requirements in these plans.

Unused Funds: Unused funds in your account do not carry over at the end of the plan year and are lost.

Using Your FSA

FSAs are administered by isolved Benefit Services

You can use your prepaid FSA benefits card to pay for expenses directly, just like a debit card. You may be asked to submit documentation of your expense.

If you have incurred a claim out of pocket, you can submit claims for reimbursement to isolvedbenefitservices.com using the FSA portal or the iFlex mobile app.

- When logging into the FSA portal for the first time, you will be asked to enter your social security number. You should enter 000-Employee ID (000-xx-xxxx).

- Once you have logged in you will be prompted to set up your account with new username and password.

Please note, the IRS requires the plan to pass certain eligibility and contribution tests in order to take contributions on a pretax basis. If the plan does not pass, your contribution may be changed. You will be notified if this applies to you.

Planning for Your FSA

Both FSAs can provide tax savings on the expenses they cover, but only if you plan accordingly. Review your expenses from past years and estimate your needs for the coming year.

- You cannot transfer money between accounts.

- You cannot change your election during the year unless you have a qualifying family status change.

- Funds do not roll over from year to year: you lose any 2024 funds remaining in your account after March 31, 2025.

- Expenses need to be incurred during the time that you have the FSA account.

What expenses are Eligible?

For the IRS list of eligible expenses, visit www.irs.gov and see Publications 502 and 503.

If you have questions regarding your FSA plans, contact isolved at fsa@isolvedhcm.com, or call (866) 370‑3040.