When you enroll in the HSA/POS Plan, you can save for future medical costs and reduce your tax bill with this special savings account.

How HSAs Work

With the HSA/POS Plan, you’re eligible to contribute money to a Health Savings Account, administered by HealthEquity. This is a tax-advantaged savings account you can use to help pay for eligible healthcare expenses as needed, or you can build up the money in your account and use it for future expenses, even during retirement.

Things To Consider:

- You can save. You decide how much to contribute each pay period (up to the federal limits) to your HSA, and can change that amount at any time.

- Company contribution: Corewell Health contributes to your HSA, up to $500 annually for individual coverage or $750 for one or more dependents. Contributions are added each pay period.

- It works like a bank account. Use account funds to pay for eligible healthcare expenses by using your debit card when you receive care, or submit a claim for reimbursement for payments you’ve made.

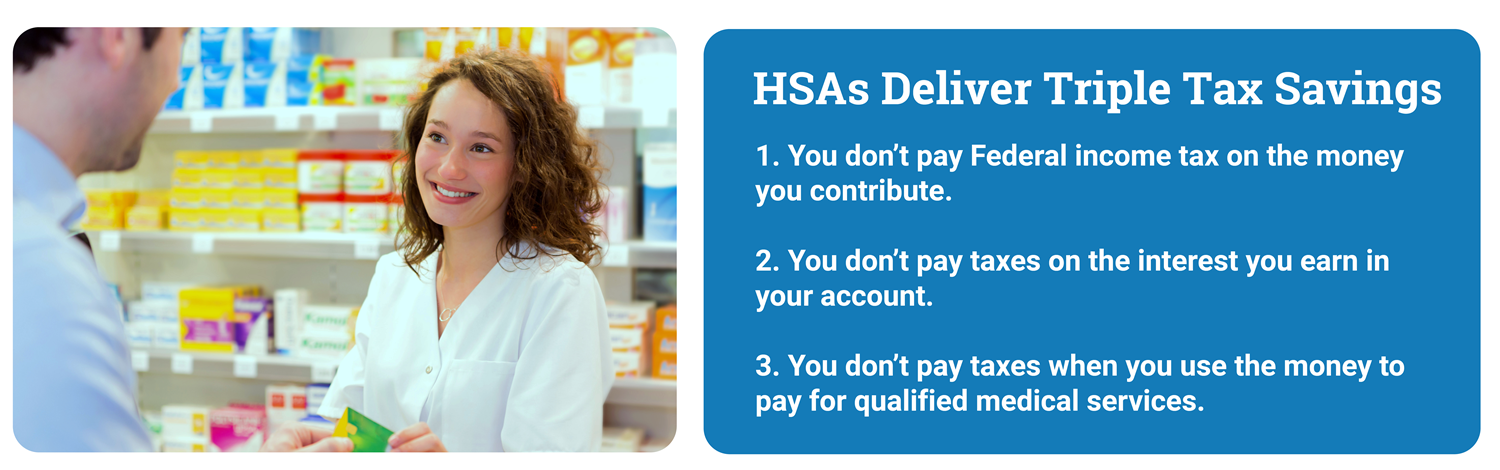

- It’s tax-advantaged. You don’t pay taxes on HSA funds.

- It’s your money. Unlike an FSA, unused funds carry over each year – you can earn tax-free interest on your HSA balance. Once your account reaches a certain amount, you will have investment choices for the money. You can take the account with you if you retire or leave Corewell Health, and save it to use during retirement.

- If you are enrolled in Medicare: you are eligible to enroll in a medical plan with HSA, but you are not eligible to contribute to or to receive Corewell Health's contribution to the Health Savings Account.

- If you are currently not enrolled in Medicare and don’t anticipate enrolling in Medicare for 2024, you are able to contribute to your HSA savings account on a pre-tax basis and Corewell Health will contribute, if eligible, as well.

Enrolling in the HealthEquity HSA

The Corewell Health HSA account partner is HealthEquity.

Once you enroll in the HSA/POS Plan, you will receive a welcome packet from HealthEquity instructing you how to set up and manage your HSA account. Once you have set your account up, you will receive your debit card so that you can start using the funds within your account.

Visit https://learn.healthequity.com/corewellhealth for

additional information. Be sure to download the

HealthEquity app from the App Store or Google

Play. If you have questions about your Health

Savings Account, you can contact HealthEquity 24

hours a day, 7 days a week at (866) 296‑2859.

Full-Time and Part-Time |

Your Contribution |

Corewell Health

|

|

55+ catch up contribution |

|---|---|---|---|---|

Team Member-Only Coverage |

$3,650 |

$500 |

$4,150 |

$1,000 |

Team Member + Additional Family Members |

$7,550 |

$750 |

$8,300 |

$1,000 |