You can protect yourself from the unexpected costs of serious illnesses.

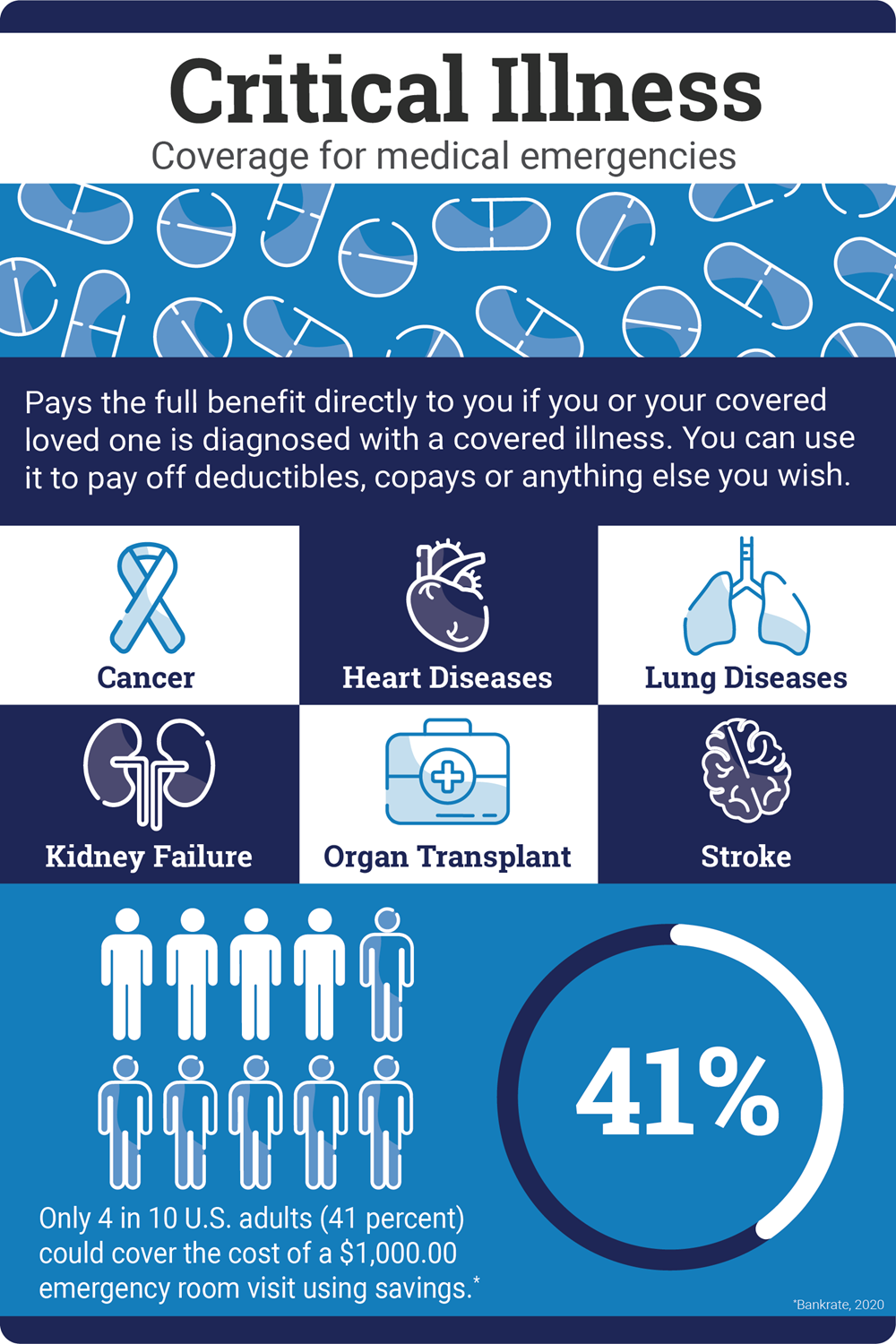

Even the most generous medical plan does not cover all the expenses of a serious medical condition like a heart attack, stroke or cancer. Critical Illness Insurance pays a lump sum benefit directly to you if you are diagnosed with a covered illness. The benefit is paid in addition to any other insurance coverage you may have and may be used any way you choose.

Some Covered Illnesses

- Heart attack

- Stroke

- Cancer

- Major organ transplant

- End stage renal (kidney) failure

Plan Features

- Guaranteed Acceptance: There are no health questions or physical exams required.

- Family Coverage: You can elect to cover your spouse and eligible children.

- Portable Coverage: You can take your coverage with you if you change jobs or retire.

- Health Screening/Wellness: The plan provides a $75 benefit per covered person per calendar year if you or your covered dependents complete a health screening test such as a physical exam, total cholesterol blood test, mammogram lipid panel and more.