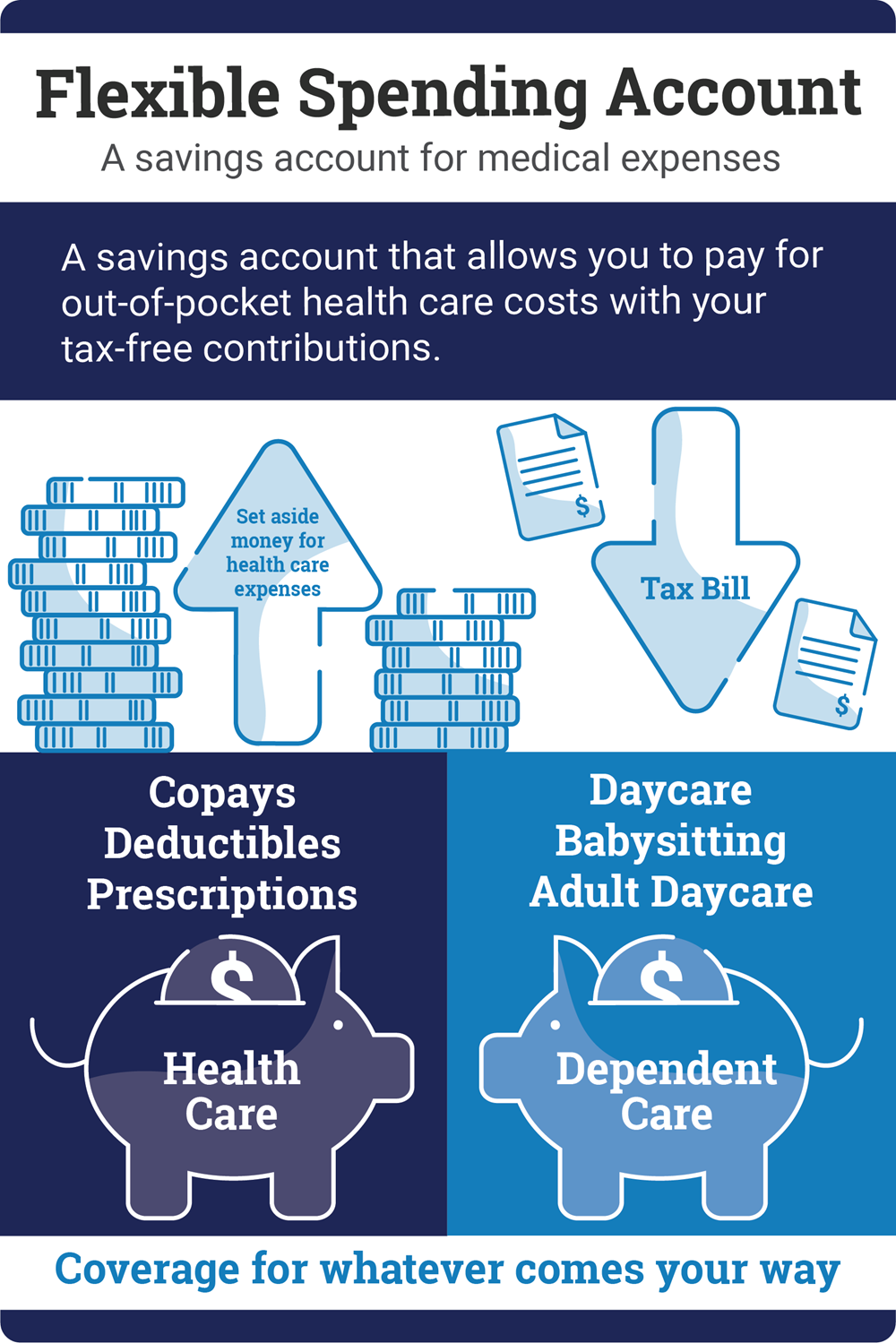

Reduce your income taxes while putting aside money for health and dependent care needs.

Endeavor Health can help you create accounts to pay for eligible medical or daycare expenses.

You fund Flexible Spending Accounts (FSAs) by setting aside part of your pay—before

taxes—through payroll deductions. If you can estimate your expenses for the coming year, this can be a good way to save on your taxes. The FSA accounts are administered by WEX.

You can enroll through Workday, then see your balance and check on claims status through your WEX website.

You Can Elect Two Kinds of FSAs:

Health Care FSA

Eligible expenses: You can use your Health Care FSA funds to pay for eligible medical, prescription drug, dental and vision expenses.

- If you enroll in the HDHP, your Health Care FSA is limited to eligible dental and vision expenses. In this case, you may use your Health Savings Account (HSA) for eligible medical and prescription drug expenses and your Health Care FSA for eligible dental and vision expenses only.

Funding the FSA: You can contribute up to $3,200 per year.

- Your entire annual contribution is available immediately once your election takes effect.

Unused funds: You can roll over $640 of unused funds in your account to the next year; anything remaining is lost.

Dependent Care FSA

Eligible expenses: Eligible child/elder daycare expenses for eligible dependents that allow you and/or your spouse/domestic partner to work or attend school full time.

- Dependent medical, dental and vision expenses are not eligible for reimbursement. A Health Care FSA should be used for these types of expenses.

Funding the FSA: You can contribute up to $5,000 per year per household.

- Your funds are available only after they have been deposited each pay period.

Unused funds: Unused funds in your account do not carry over at the end of the plan year and are lost.

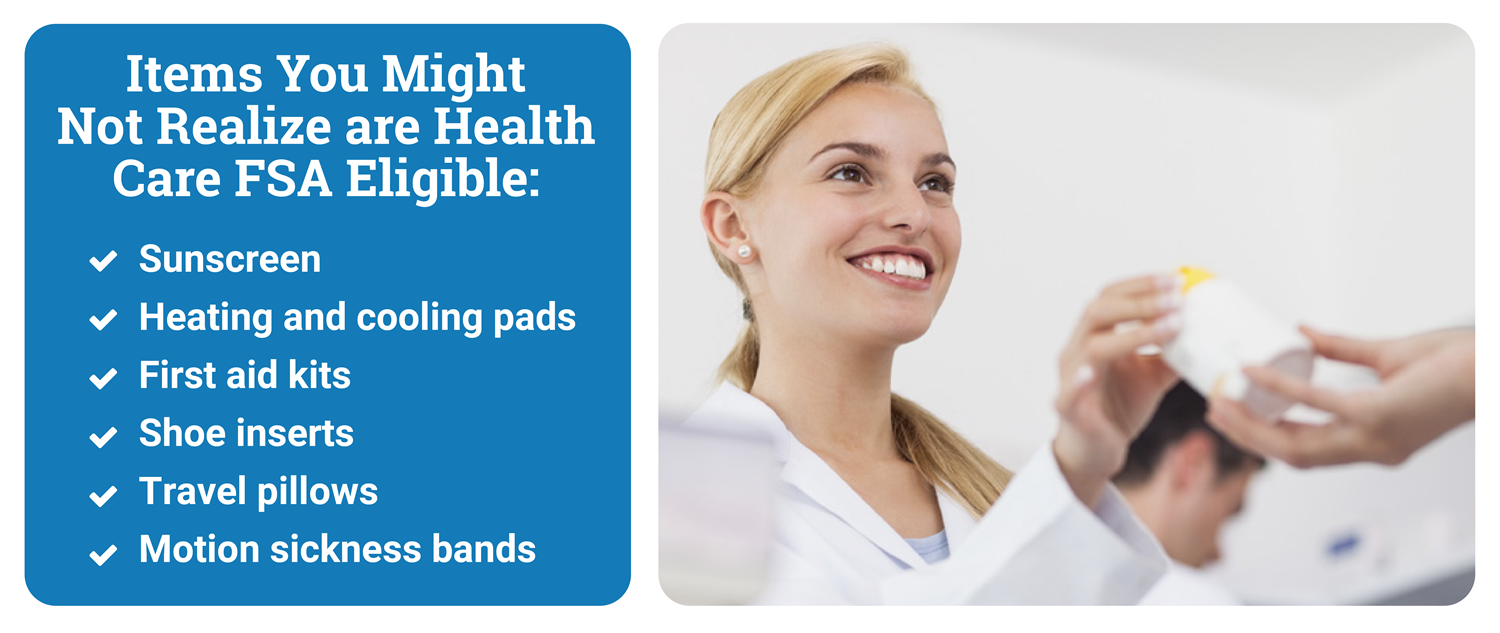

What Expenses Are Eligible?

For a complete list of eligible expenses established by the IRS, visit www.irs.gov and see Publications 502 and 503.

Examples of Health Care FSA eligible expenses:

- Office visits

- Prescription drugs

- Hospital stays and lab work

- Speech/occupation/physical therapy

- Dental and vision care

Examples of Dependent Care FSA eligible expenses:

- Childcare

- Adult day care

- After school programs

- At-home elder care

Keep documentation of how you used the money in these accounts for tax purposes.

Important: By law, Flexible Spending Accounts (FSAs) may not unfairly favor “highly compensated individuals”, as defined by the IRS. Therefore, the plan administrator may need to reduce highly compensated employee contributions to the Health Care FSA and/or Dependent Care FSA mid-year to ensure that the FSAs comply with the law.

The plan administrator will generally notify you no later than the second quarter of the calendar year if you are affected by these rules.