Save for future medical costs and reduce your tax bill with this special savings account only available to HDHP plan participants.

Save for future medical costs and reduce your tax bill with this special savings account only available to $2,500 HDHP plan participants.

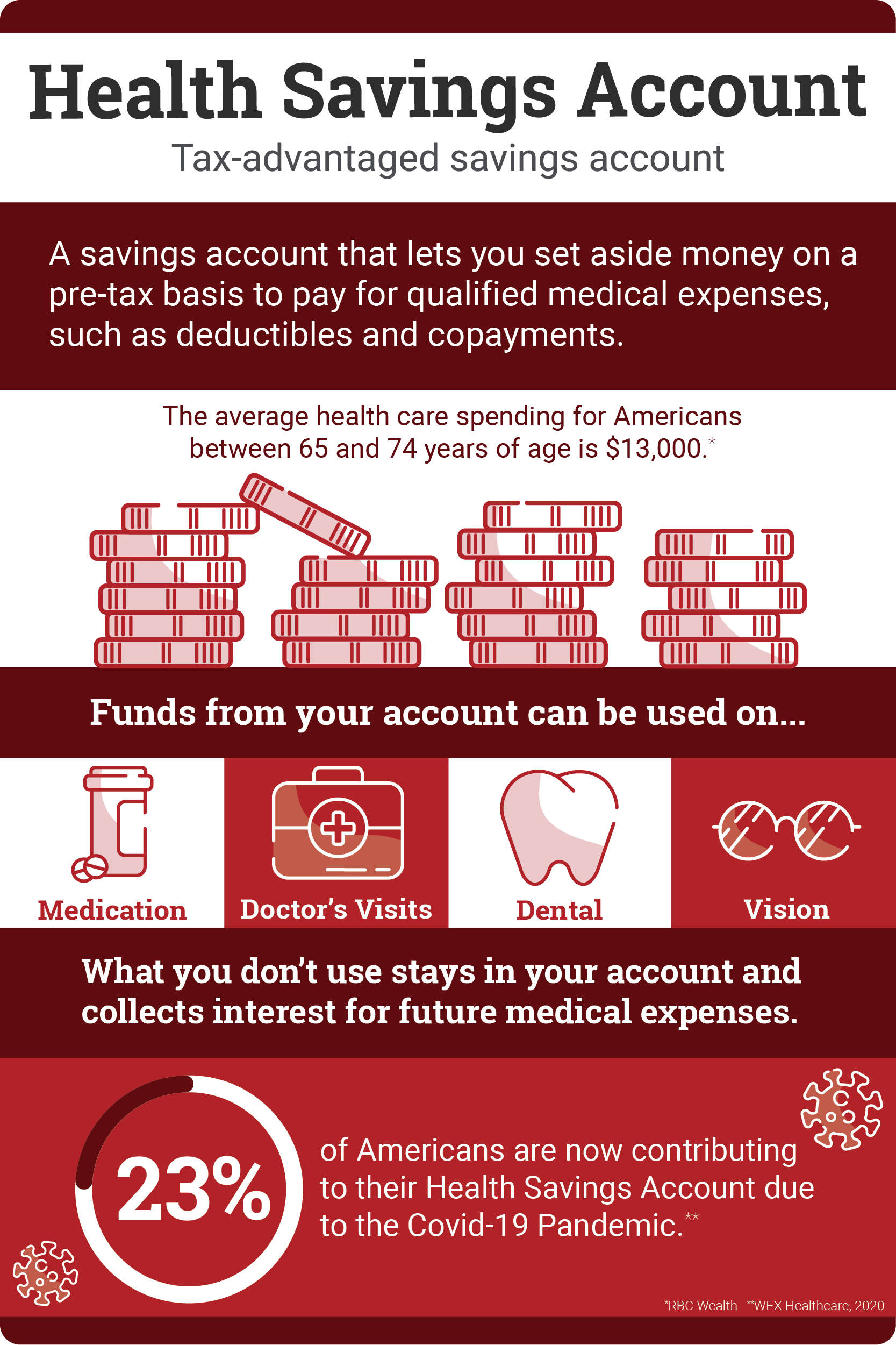

Out-of-pocket medical expenses can add up quickly. Over time, health care likely will be your largest household expense. A Health Savings Account allows you to build up protection for future health care expenses.

Along with Ollie’s contributions, you can contribute money to your HSA and use it at any time for qualified health care expenses. Whatever you don’t use rolls over for future years and earns interest. Better yet, HSAs provide tax advantages.

HSAs Deliver Triple Tax Advantages:

- You don’t pay federal income tax on the money you contribute.

- You don’t pay taxes on the interest you earn in your account.

- You don’t pay taxes when you use the money to pay for qualified medical services.

Keys to Growing Your HSA:

- Try not to use your HSA for routine expenses. If you can pay out-of-pocket, leave your HSA funds alone so that they can grow for when you need them in the future.

- Consider electing supplemental medical plans to cover big-ticket expenses from unexpected serious illnesses or injuries and ensure they don’t wipe away the money in your HSA.

- Monitor your fund’s growth. Like a 401(k), your HSA funds earn interest through investments. Make sure your money is growing at an acceptable and safe pace.

How much can you contribute? |

2023 IRS Contribution Limit |

Ollie’s 2023 Contribution |

Your Maximum Contribution |

|---|---|---|---|

Individual Coverage |

$3,850 |

$250 |

$3,600 |

Family Coverage |

$7,750 |

$500 |

$7,250 |

HSA Debit Card Example