Your ability to bring home a paycheck is your most valuable asset. We help you protect it.

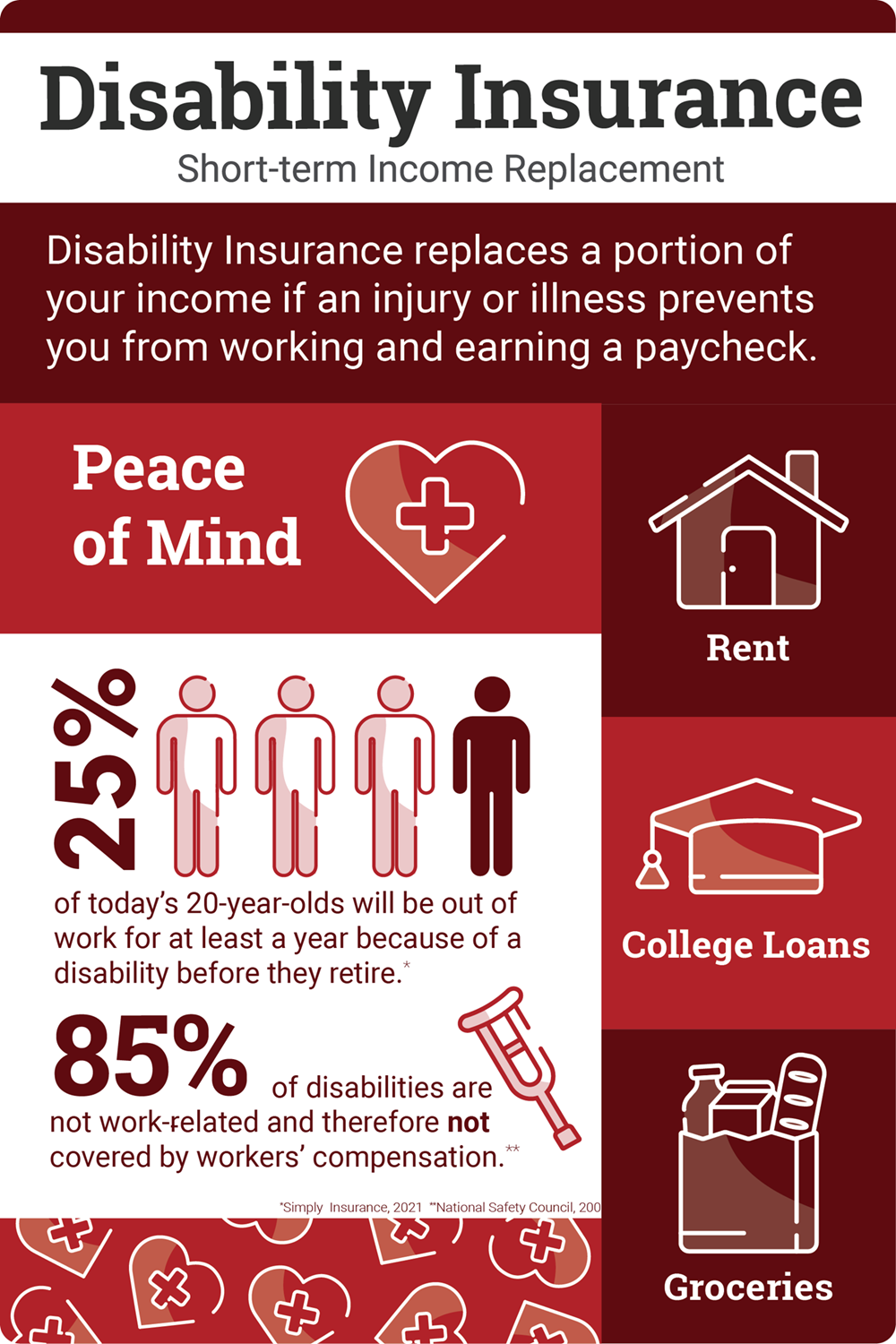

A disabling injury or illness that keeps you out of work could have a devastating impact on your income, jeopardizing your ability to cover normal household expenses. With the right disability insurance, your income is protected, relieving you of the anxiety of depleting your savings to pay your bills.

Short-Term Disability Insurance

Depending on your household budget, you may need additional disability coverage. To help you increase your disability protection, Ollies has negotiated a special rate that allows eligible employees to purchase additional Short-Term coverage at an affordable cost. This voluntary coverage allows you to choose the amount of extra coverage you need. You can keep this policy if you leave Ollies.

Short-Term Disability Insurance replaces a portion of your income if an injury or illness forces you out of work for an extended period of time. Ollie’s provides Basic Short-Term Disability coverage to eligible Associates at no cost, and enrollment is automatic.

Upon filing a claim for a qualifying illness or injury, after the fifteenth consecutive day of disability you will receive 60% of your basic weekly earnings, up to a benefit maximum. Benefits will continue for up to 11 weeks.

A voluntary disability option is available for all other Associates who are not eligible for the company-paid benefit.

Long-Term Disability Insurance

Ollie’s also provides Long-Term Disability Insurance to protect your finances when your disability continues beyond the period covered by the Short-Term Disability plan.

Ollie’s provides eligible Associates with a core Long-Term Disability benefit at no cost. The benefit is 60% of basic monthly earnings, up to a stated benefit maximum. There is a 90-day elimination period, and benefits are paid to normal Social Security retirement age.