You can protect yourself from the unexpected costs of a serious illness.

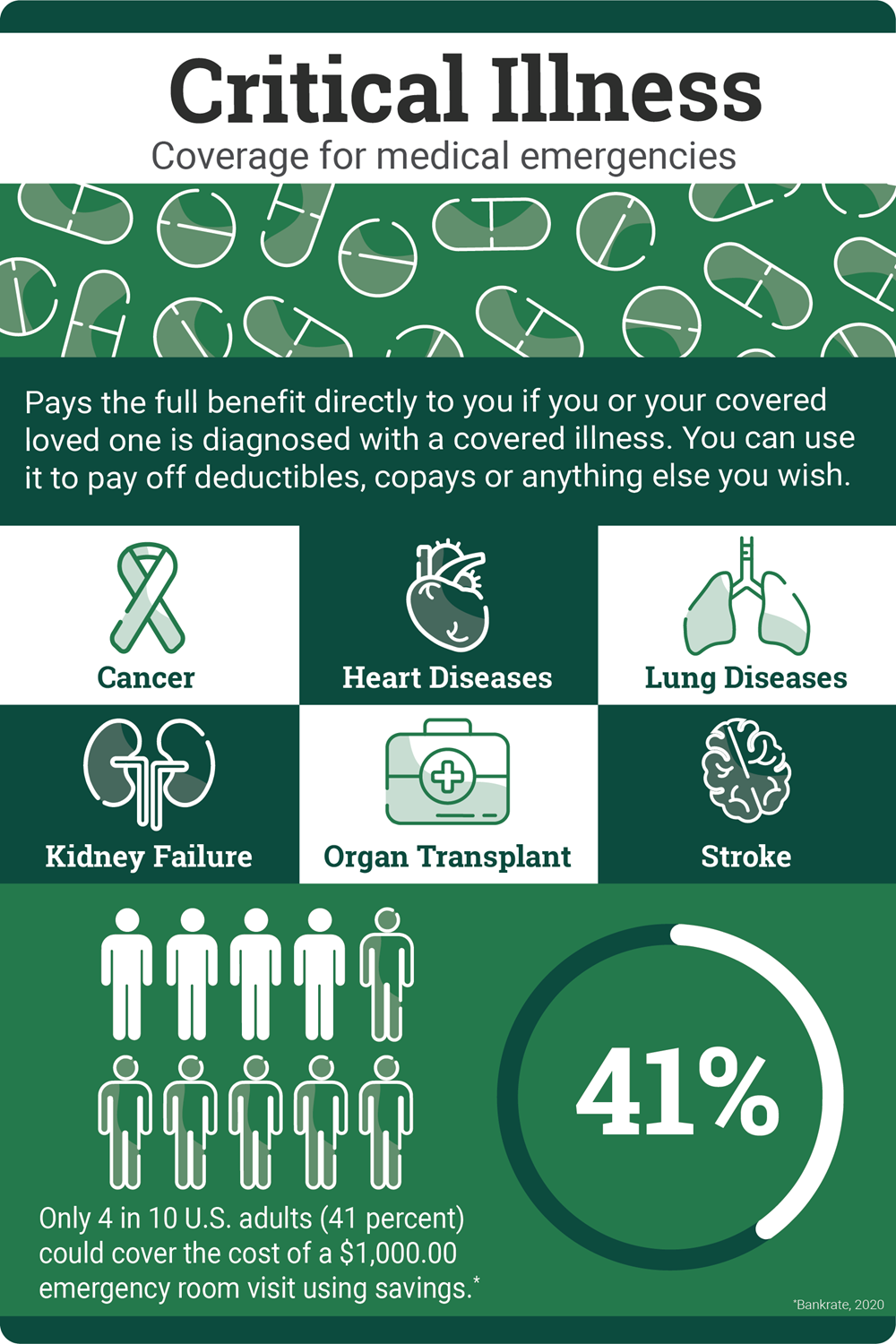

The out-of-pocket costs of a serious illness can be catastrophic, even with medical insurance. Critical Illness Insurance helps provide financial protection in the event of a covered serious illness. The policy pays a lump sum benefit directly to you if you or a covered family member are diagnosed with a covered illness. You can use this benefit any way you choose – deductibles and coinsurance, expenses your family incurs to be by your side, or simply to replace your lost earnings from being out of work.

You choose the benefit amount when you enroll – $10,000, $20,000 or $30,000.

For newly eligible employees, this coverage is Guaranteed Issue! No health questions or physical exams are required.

Critical Illness Insurance is a limited benefit policy. This is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act.

Access your plan summary below for the cost of coverage:

Covered Illnesses

- Heart Attack

- Stroke

- Cancer

- Major Organ Transplant

- Alzheimer's Disease

- Coronary Artery Bypass Surgery*

See the product brochure, certificate of coverage and any applicable riders for a complete list of covered conditions, along with complete provisions, exclusions and limitations.

The policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations which may affect any benefits payable.

Plan Features

- Family Coverage: You can elect to cover your spouse and children.*

- Portable Coverage: You can take your policy with you if you change jobs or retire.

- Health Screening Benefit: The plan provides a $50 benefit per covered person per calendar year if you or your covered dependents complete a covered health screening test such as a physical exam, total cholesterol blood test, mammogram, lipid panel, and more.

For additional information on Critical Illness Insurance, click here.

This plan is not a replacement for medical insurance.

*If you elect coverage for your dependent children, you must provide notification to your employer when all of your dependent children exceed the dependent child age limit or no longer otherwise meet the definition of a dependent child.