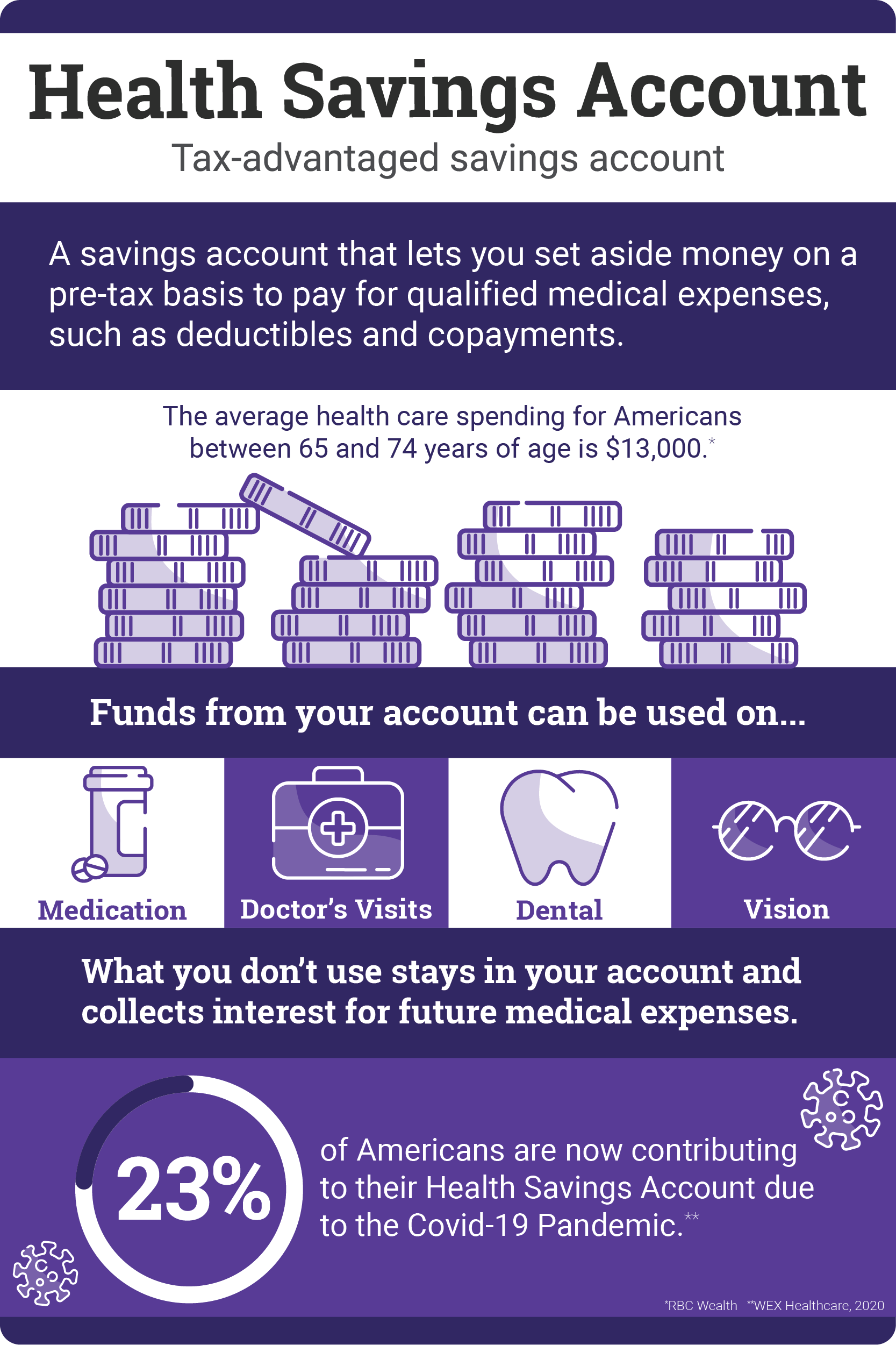

Save for future medical costs and reduce your tax bill with this special savings account available to HDHP plan participants.

Most people use their HSAs during their working years to pay for medical expenses that aren’t covered by insurance, such as deductibles, copayments and non-covered items.

A better strategy is to treat your HSA like an additional Retirement Account.

- Fully fund the HSA during your working years and pay current medical expenses from non-HSA sources to the extent you can.

- Invest those HSA savings into optional investment funds offered by OptumBank

- Remember to periodically monitor your HSA investment fund performance at OptumBank

Important Documents