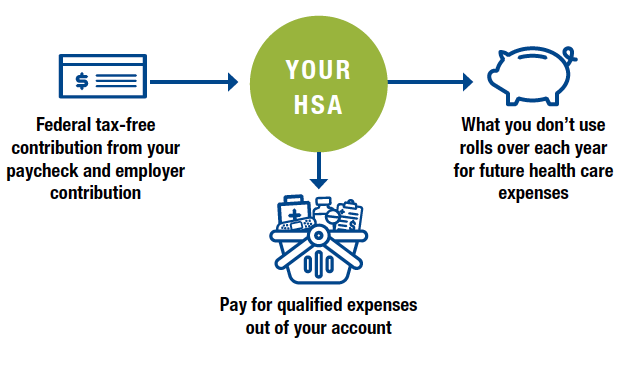

Save for future medical costs and reduce your tax bill with this special savings account available to Anthem CDHP and Kaiser CDHP plan participants.

As you get older, your out-of-pocket medical expenses rise. By the time you retire, health care will likely be your largest household expense, even with Medicare. A Health Savings Account is portable and rolls over from year-to-year allowing you build up protection for future health care expenses.

Grifols contributes money to your HSA and you can contribute money to use any time for qualified health care expenses.

Whatever you don’t use rolls over for future years and earns interest. Better yet, HSAs provide tax advantages.

Keys to Growing Your HSA:

- Try not to use your HSA for routine expenses. If you can pay out-of-pocket, leave your HSA funds alone so that they can grow for when you need them in the future.

- Consider electing supplemental medical plans to cover big ticket expenses from unexpected serious injuries or accidents and ensure they don’t wipe away the money in your HSA.

- Similar to a 401(k), your HSA funds earn interest through investments Once your HSA account balance reaches $1000, funds above the initial$1,000 contribution can be invested. Make sure your money is growing at an acceptable and safe pace.

HOW MUCH CAN YOU CONTRIBUTE? |

ANNUAL IRS CONTRIBUTION LIMIT |

ANNUAL GRIFOLS CONTRIBUTION |

YOUR MAXIMUM CONTRIBUTION AMOUNT |

|---|---|---|---|

Individual Coverage |

$4,150* |

$500 |

$3,650 |

Family Coverage |

$8,300* |

$1,000 |

$7,300 |

*Total IRS contribution limits for 2024 include Grifols contributions. Individuals age 55 or older can make an additional $1,000 in “catch up” contributions.

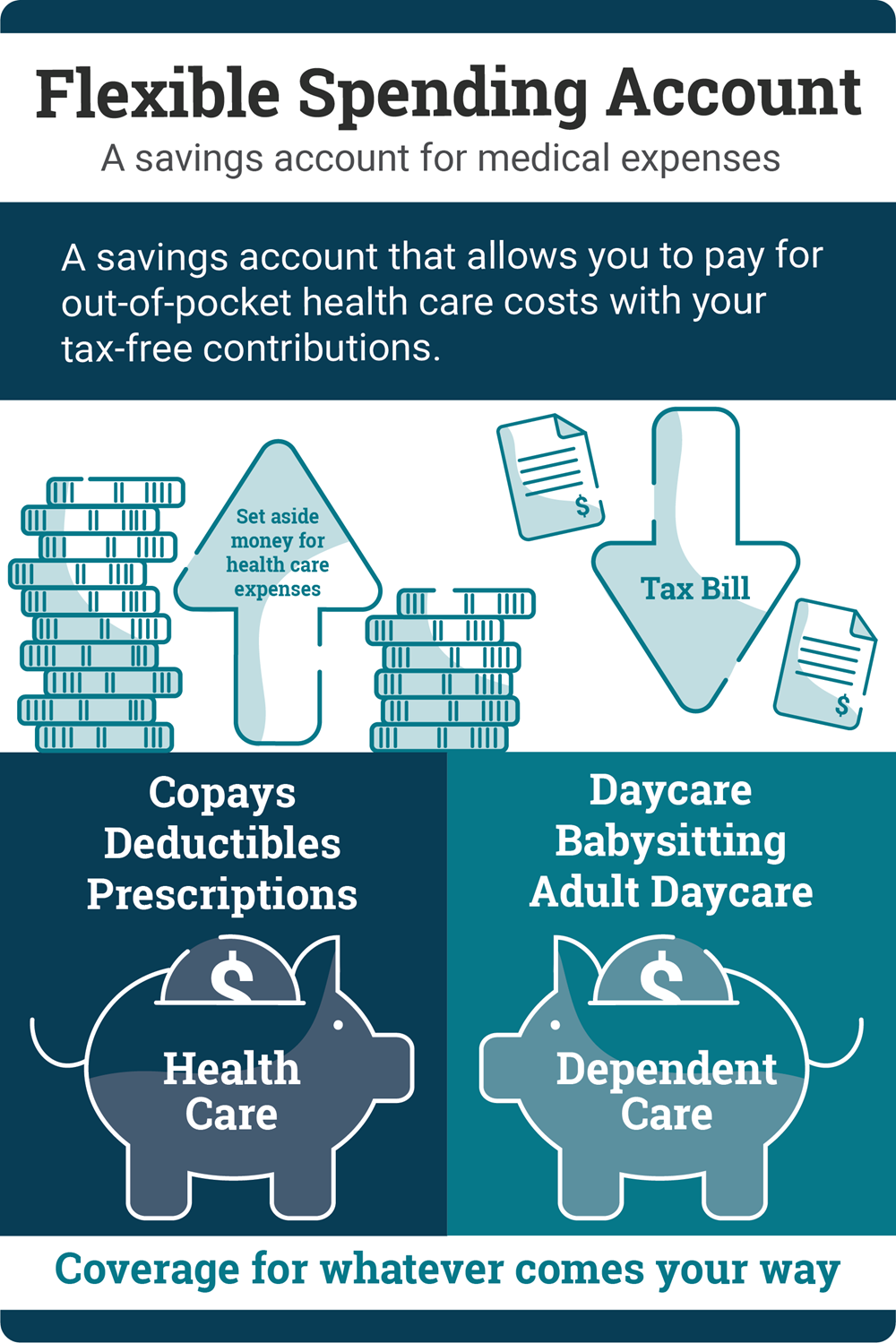

FSA - Reduce your income taxes while putting aside money for health and dependent care needs.

Flexible Spending Accounts (FSAs) allow you to put aside money for important expenses and help you reduce your income taxes at the same time. Grifols offers three types of Flexible Spending Accounts — a Health Care Flexible Spending Account, Limited Purpose Health Care Flexible Spending Account, and a Dependent Care Flexible Spending Account.

USE IT OR LOSE IT: Be sure to calculate your FSA contributions carefully. You can only roll over between $5 and $610 from year-to-year, and you will have to actively elect a goal amount annually. You are not automatically re-enrolled. Dependent Care FSA funds DO NOT roll over.

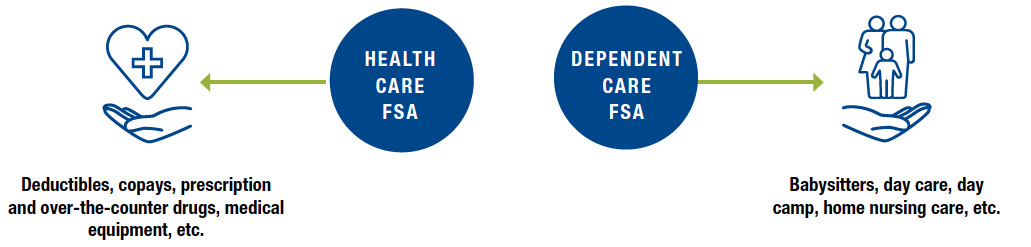

Health Care FSA

Use it to pay for deductibles, copays, prescription and over-the-counter drugs, medical equipment, etc.

Dependent Care FSA

Us it to pay for babysitters, day care, day camp, home nursing care, etc.

How Flexible Spending Accounts Work

- Each year during the Open Enrollment period, you decide how much to set aside for health care and/or dependent care expenses. Your full contribution amount will be available for use on your benefit effective date except Dependent Care FSAs where only the contributions you’ve already made are available. Your contributions are then deducted as you use the funds to pay for qualified expenses.

- Your contributions are deducted from your paycheck on a pre-tax basis in equal installments throughout the calendar year.

- As you incur health care expenses throughout the year, use your FSA card to pay for eligible expenses at the point of sale, or submit a claim form for reimbursement if necessary.

Limited Purpose Health Care FSA

This account works together with your Consumer Driven Health Plan (CDHP) and Health Savings Account (HSA).

Eligible expenses include:

- Vision care, including prescription eyeglasses, contact lenses, and laser eye surgery

- Out-of-pocket dental services or orthodontia

- Upon reaching your CDHP deductible, use this account for reimbursement of out-of-pocket medical and prescription drug expenses

|

Annual Maximum Contribution |

|

|---|---|

Healthcare Flexible Spending Account |

$3,050 |

Dependent Flexible Spending Account |

$5,000 ($2,500 if married and filing separate tax returns) |

Please note that these accounts are separate. You cannot use money from the Health Care FSAs to cover expenses eligible under the Dependent Care FSA or vice versa.