You can protect yourself from the unexpected costs of a serious illness.

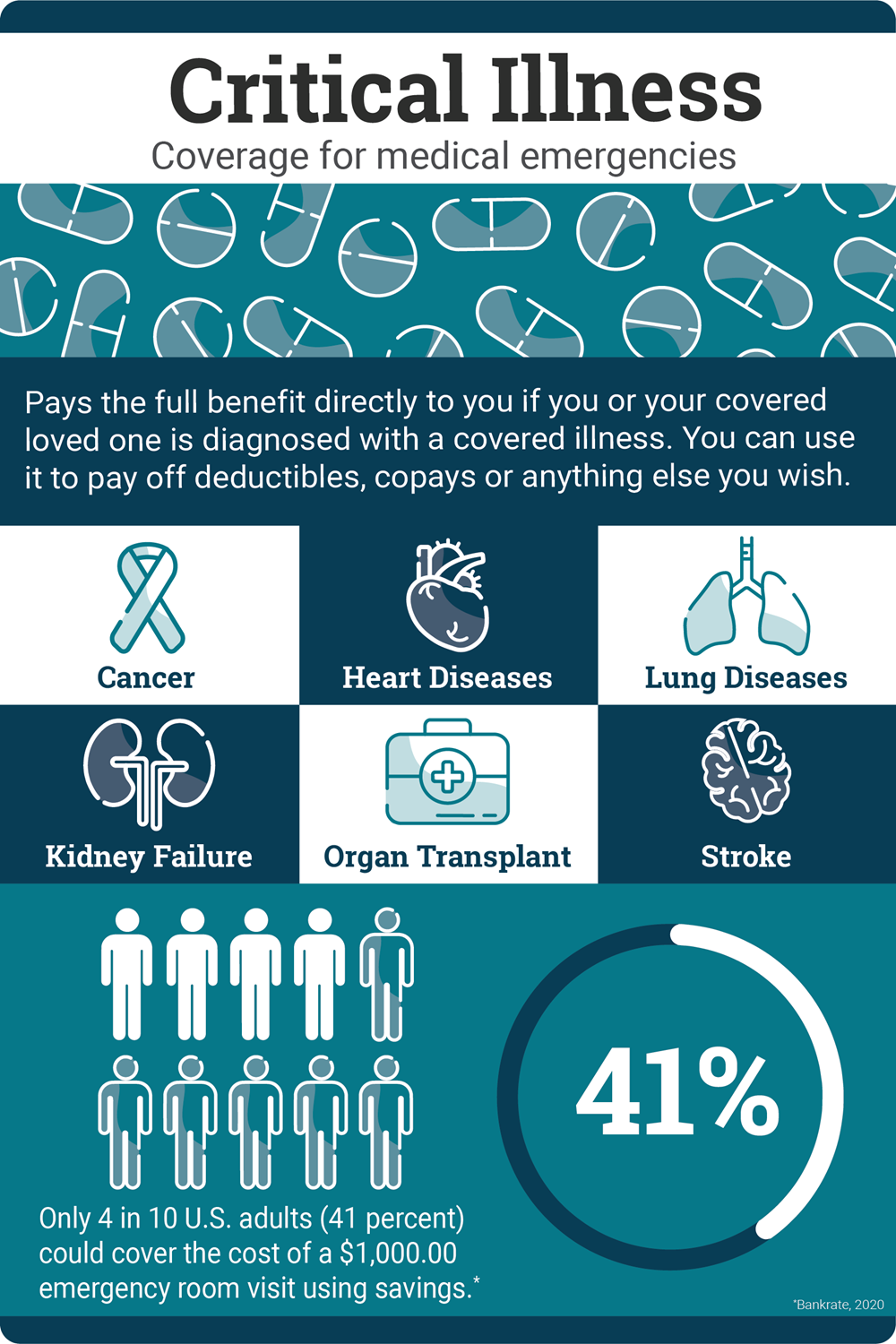

Even the most generous medical plan does not cover all of the expenses of a serious medical condition like a heart attack or cancer. Critical Illness Insurance from Securian pays a full lump sum benefit directly to you if you are diagnosed with a covered illness. The benefit is paid in addition to any other insurance coverage you may have. You can choose to elect $10,000, $20,000, $30,000, or $40,000 in coverage.

How Critical Illness Insurance Works

When Marco had a heart attack, he was grateful his doctors were able to stabilize his condition. He learned there was some permanent damage to his heart. He began to see his costs adding up quickly. The good news is Marco received a lump sum payment of $10,000 to help cover these expenses from the Critical Illness coverage he elected during Open Enrollment.

This scenario is an example. See the plan details for the benefit schedule for the plan offered to you.

Covered Illnesses

- Heart Attack

- Stroke

- Cancer

- Major Organ Transplant

- End Stage Renal (Kidney) Failure

- Coronary Artery Bypass Surgery*

- COVID-19*

Plan Features

- Guaranteed Issue: There are no health questions or physical exams required.

- Family Coverage: You can elect to cover your spouse and children. Guaranteed Issue is 50% of the employee benefit amount.

- Wellness Benefit: The plan provides a $50 benefit per covered person per calendar year if you or your covered dependents complete a covered health screening test such as a physical exam, total cholesterol blood test, mammogram, lipid panel and more.

- Portable Coverage: You can take your policy with you if you change jobs or retire.

*The coverage pays 25% of the face amount of the policy once per lifetime for coronary bypass surgery and COVID-19. For benefit to be payable, the covered person must have been treated for COVID-19 in the hospital for five consecutive days. This rider may not be available in all states.

The policy/certificate of coverage or its provisions, as well as covered illnesses, may vary or be unavailable in some states. In New York, a Specified Disease product is offered. The policy/certificate of coverage has exclusions and limitations which may affect any benefits payable.