Always be there financially for your loved ones.

Your family depends on your income for a comfortable lifestyle and for the resources necessary to maintain their lifestyle and make their dreams a reality. You likely don’t think of a scenario where you’re no longer there for your family, but you need to ensure their future is financially secure.

Grifols knows how difficult it can be to provide this peace of mind on your own, which is why we have made it a priority to give you the ability to assemble a complete Life Insurance portfolio.

Basic Term Life and Accidental Death and Dismemberment Insurance

Grifols provides eligible employees with Basic Term Life and Accidental Death and Dismemberment (AD&D) coverage at no cost to you and enrollment is automatic.

|

Basic Term Life |

The benefit is equal to your base annual earnings |

|---|---|

Accidental Death & Dismemberment |

If you are seriously injured or lose your life in an accident, you will be eligible for a benefit equal to your basic term life coverage. |

Supplemental Life and Accidental Death and Dismemberment Insurance

You may also choose to purchase Supplemental Life Insurance coverage in addition to the company-paid benefit. You pay the total cost of this benefit through convenient payroll deductions.

|

Available Coverage |

New Hires & Open Enrollment Elections |

|

|---|---|---|

EMPLOYEE |

1x-8x you basic annual earnings |

EOI required for elections over 3x annual earnings or amounts over $500,000, whichever is less |

SPOUSE |

Increments of $10,000 to maximum of $250,000 |

EOI required for any elections over $50,000 |

CHILDREN |

Increments of $5,000 to maximum of $20,000 |

No EIO required |

If turning 70-74, employee Life and AD&D coverage is reduced to 65%. If turning 75 or older, employee Life and AD&D coverage is reduced to 55%. Spouse/Domestic Partner coverage ends at age 70 with the ability to covert to an individual policy.

How Much Life Insurance Do You Need?

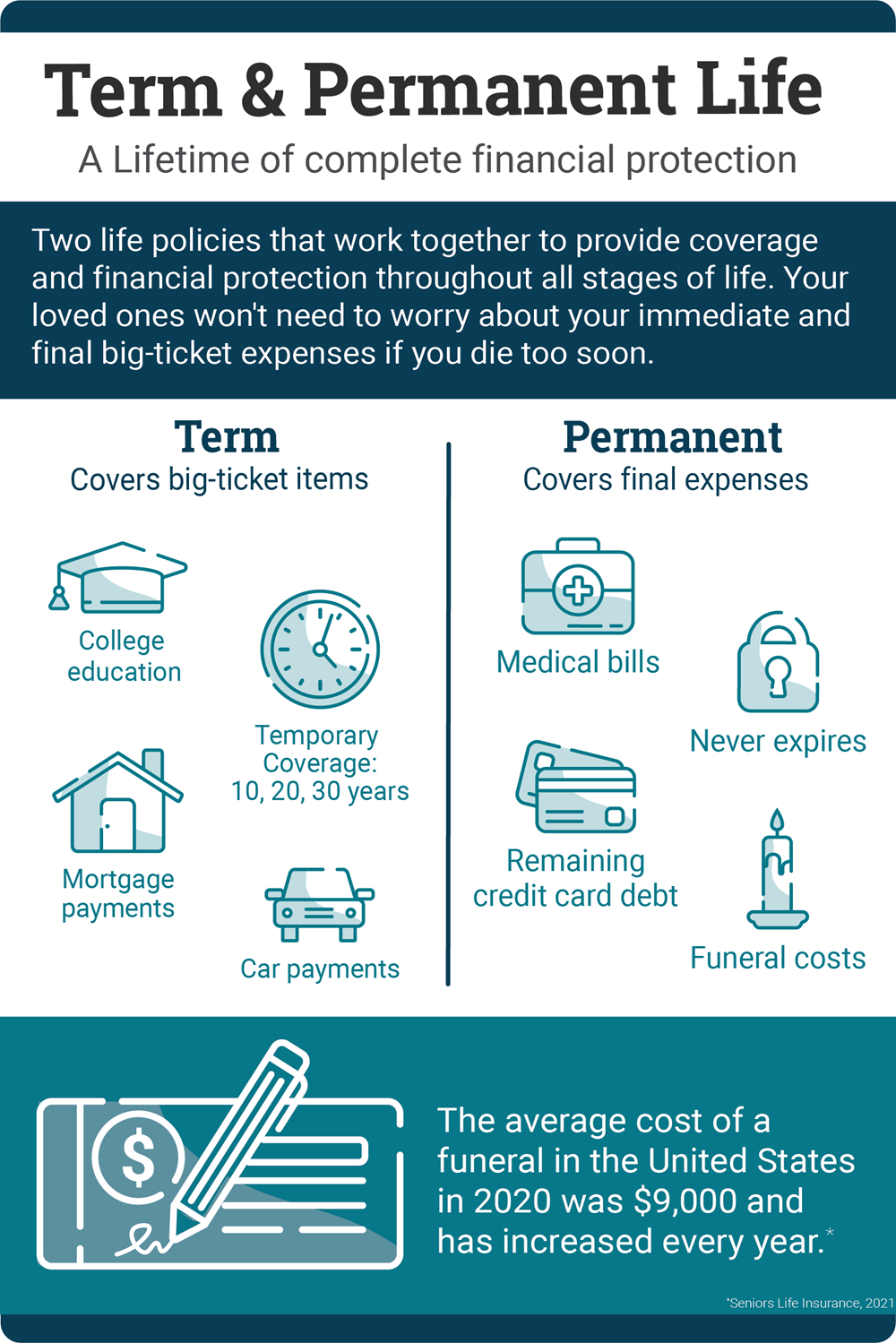

Many financial experts recommend you have at least five to eight times your household income in Life Insurance. To calculate the level sufficient to cover your needs, you should consider your current income and how much it costs to maintain your family’s standard of living. You should also consider your current expenses and your family’s future financial needs such as the following:

Current Expenses:

- Home Mortgage

- Car Payments

- Credit Card Debt

- Other Debt

Future Needs:

- Child Care

- College Tuition

- Spouse’s Retirement

- Routine Household Expenses

After you add your financial responsibilities, how does the sum compare with your current coverage?

For more information visit the Voya Employee Benefits Resource Center