Health care needs are different for everyone. Our medical plan offers multiple options so you can choose the coverage level best-suited to your needs and budget.

If you are located out of the Wilkes-Barre Distribution Center, you are eligible for our Geisinger medical plans. You have three plans to choose from: Geisinger CDHP Plus, Geisinger HMO Core, Geisinger HMO Basic. These plans are administered by the Geisinger network and include prescription drug coverage. Click here to learn more: www.geisinger.org.

What is a HMO?

HMO stands for health maintenance organization. The benefit to HMO plans is that there are clear copays and/or coinsurance that are outlined so you know in advance what you may pay. However, these plans are often at a higher per pay period cost. The Geisinger HMO Core and Geisinger HMO Basic plans are considered HMO’s which allow Associates to enroll in a Flexible Spending Account (FSA) that you can use for eligible out-of-pocket expenses. Click to learn more about Flexible Spending Accounts.

What is a CDHP?

A CDHP is a consumer driven health plan. The benefit to a consumer driven health plan is to allow our HBC Associates to truly be consumers of their health plan. The Geisinger CDHP Plus Plan is considered a consumer driven health plan, which allow Associates to enroll in a Health Savings Account (HSA) that you can use for eligible out-of-pocket expenses. Click to learn more about Health Savings Accounts.

Plan Comparison Chart

Click below to compare our Geisinger plans to ensure you select the one that is best for you and your family.

2025 Summary of Benefits and Coverage

2025 Benefit Summary

2025 Summary Plan Description

Wellness Incentive

Wellness incentive employer contributions will be made to your Flexible Spending Account (FSA) if you are enrolled in the Geisinger Core or Basic HMO plans or into your Healthcare Savings Account (HSA) if you are enrolled in either the Geisinger CDHP Plus plan.

To be eligible for the full wellness incentive, you must complete:

1. Health Risk Assessment: Become aware of ways to enhance your personal health and well-being through the completion of your confidential Health Risk Assessment (HRA);

2. Physician Engagement: Engage with your personal physician through an annual wellness visit

Create your account and sign in to the Geisinger Wellness Portal.

Review the Geisinger Wellness Packet or visit the Wellness Incentive page to learn more!

Questions?

Geisinger Pharmacy

This is a list of the most commonly prescribed medications covered as of January 1, 2025. The drug list is updated often so it isn’t a complete list of the medications your plan covers. Also, your specific plan may not cover all of these medications. Visit www.geisinger.org, to see all of the medications your plan covers.

View the drug list online www.geisinger.org, Select the ‘Geisinger Triple Choice Formulary’, then open the printable formulary. There is also a tool to search for the covered drug within the formulary or find a pharmacy.

Please note, certain generic prescriptions have a $0 copay, view the full list here.

Questions?

Call the toll-free number on the back of your Geisinger ID card.

Medical Glossary

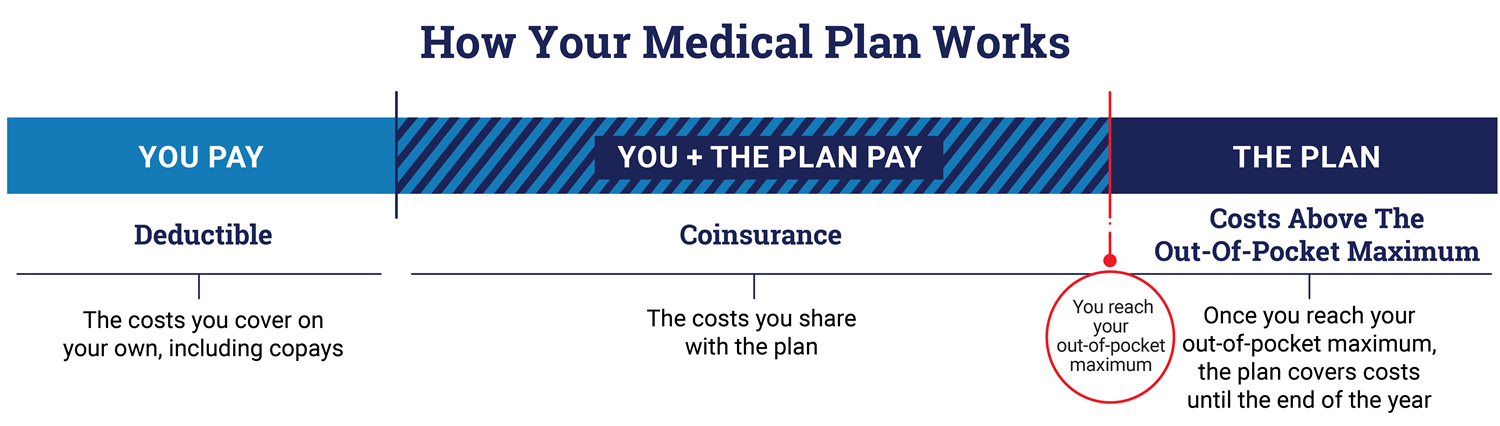

Deductible - The amount you must pay for medical services, before the plan pays a benefit. Preventative care is always covered at 100% with no deductible required.

Coinsurance - This is the percentage of the cost you pay for certain services after the deductible has been met. You can think of this as “cost sharing”. For example, once your deductible has been met you could pay 20% for the cost of certain services and the plan could pay 80%.

Copay - The flat fee paid by the member when a medical service is received, i.e. $20 for a doctor's visit or $20 for a prescription.

In Network Provider - An in-network provider is a hospital, doctor, medical group, and/or other healthcare provider contracted to provide services to insurance company customers for a discounted fee. Using these providers will lessen your medical expenses when using your benefits.

Out of Network Provider - An out of network provider is a hospital, doctor, medical group, or other healthcare provider who are not contracted to provide services to insurance company customers. Because the fees are not negotiated in advance with the insurance company, the provider can charge the member as much as they wish.

Out of Pocket Maximum - The maximum amount a member would have to pay out of their pocket for medical expenses for the year, with the exception of benefit premiums (which come out of your paycheck). Your out-of-pocket maximum includes your deductible, any coinsurance paid and all co-payments (medical and prescription drug).

My Geisinger Portal

My Geisinger Portal

MyGeisinger gives you convenient access to your Geisinger medical record, allowing you to schedule appointments, message your care team, view your lab and test results, and more!

- Access MyGeisinger on-the-go with the MyChart App

- Manage and schedule appointments

- Preventive Care Services

- View most lab and test results

- View medications and request prescription renewals

- Message your doctor and care team

- 24/7 access to your or your loved one’s medical record

To create and access your account visit MyGeisinger

Questions? MyGeisinger Patient Portal FAQ