Endeavor Health offers three systemwide medical plans administered by Cigna.

What's the right plan for you?

The NS-EEH System Plan gives you access to Endeavor Health hospitals, providers and other services, with the highest level of coverage and the lowest payroll deductions. The other two medical plans offer access to both Endeavor Health hospitals and providers as well as the nationwide Cigna network of providers at a higher cost.

What will you pay for your medical plan?

Your medical payroll deductions depend on the plan you choose, the coverage level you elect, and your full-time or part-time status. Payroll deductions are standard across the Endeavor Health system; you pay the same regardless of your role or where you work.

NS-EEH System Plan - Learn More

This plan has the lowest payroll deductions and out-of-pocket costs.

Except for emergencies, the NS-EEH System Plan only covers care at Endeavor Health and select in-network partners.

High Deductible Health Plan (HDHP) - Learn More

The high-deductible health plan balances mid-range payroll deductions with the highest out-of pocket costs and access to the NS-EEH network, as well as the nation-wide Cigna network. Endeavor Health helps offset these costs with a company match when you contribute to a Health Savings Account (HSA). Hospital Indemnity Insurance is automatically included with this plan at no additional cost.

Exclusive Provider Organization (EPO) Plan - Learn More

With the highest premiums, this plan provides access to the Endeavor Health System, as well as the nationwide Cigna network with moderate out-of-pocket costs. You pay less at Endeavor Health system providers.

|

|

|

|

|---|---|---|---|

Your Payroll Deduction |

$ |

$$ |

$$$ |

Network |

NS-EEH System Network Only* |

NS-EEH System as well as nationwide Cigna network of providers |

NS-EEH System as well as nationwide Cigna network of providers |

Deductible at NS-EEH |

$250 individual $500 family |

$1,600 individual $3,200 family |

$700 individual $1,400 family |

Deductible in Cigna network |

Not included in plan |

$4,000 individual $8,000 family (true family deductible) |

$1,600 individual $3,200 family |

Health Savings Account |

No |

Yes, your contribution is matched by Endeavor Health up to $600 individual /$1,200 family |

No |

* except in cases of emergencies or care that NS-EEH does not provide.

2024 Medical Bi-Weekly Payroll Deductions

Full-Time (FT) Employees

|

|

HDHP |

EPO Plan |

|---|---|---|---|

Employee |

$50 |

$69 |

$124 |

Employee + Spouse |

$129 |

$170 |

$304 |

Employee + Child(ren) |

$95 |

$132 |

$236 |

Family |

$174 |

$232 |

$416 |

Part-Time 1 (PT1) Employees

|

|

HDHP |

EPO Plan |

|---|---|---|---|

Employee |

$50 |

$98 |

$155 |

Employee + Spouse |

$129 |

$232 |

$372 |

Employee + Child(ren) |

$95 |

$186 |

$294 |

Family |

$174 |

$320 |

$512 |

* Payroll deductions for FT and PT1 employees on the NS-EEH System Plan are identical.

Part-Time 2 (PT2) Employees

|

|

HDHP |

EPO Plan |

|---|---|---|---|

Employee |

$130 |

$140 |

$201 |

Employee + Spouse |

$306 |

$325 |

$475 |

Employee + Child(ren) |

$248 |

$266 |

$383 |

Family |

$423 |

$451 |

$656 |

Network & Providers

Our medical plans center care around Endeavor Health facilities, providers, and services. The NS-EEH System Plan gives you best-in-class care at Endeavor Health at the lowest cost to you. You can also choose to enroll in one of our national-network plans, which give you access to the full Cigna network at a higher cost.

The NS-EEH System Network:

Endeavor Health is the third largest healthcare delivery system in Illinois with nine hospitals, nearly 2,400 beds and over 6,000 physicians at more than 300 local offices. The system serves 4.2 million residents across six northeast Illinois counties from Lake County to Will County.

This system drives our plans. All three of our medical plans have enhanced coverage within the NS-EEH System Network, which also includes Duly Health and Care, Cigna Behavioral Health Providers, pediatric care through Advocate providers and facilities, and adult specialty care at UChicago Medicine. Except for emergencies, the NS-EEH System Plan only covers care within the System Network.

System Hospitals Include:

- Edward Hospital

- Elmhurst Hospital

- Evanston Hospital

- Glenbrook Hospital

- Highland Park Hospital

- Linden Oaks Behavioral Health

- Northwest Community Healthcare

- Skokie Hospital

- Swedish Hospital

National Cigna Network

The High Deductible Health Plan (HDHP) and the Exclusive Provider Organization (EPO) Plan give you access to the Cigna Open Access Plus (OAP) network, as well as the Cigna behavioral health network.

The Cigna network covers providers, hospital facilities, urgent care centers, labs, imaging, and more across the United States. No matter where you live, there are providers near you. Visit the websites on this page to find the services you need.

Out-of-Network Care Is Not Included

The medical plans only cover medical care received within the Endeavor Health or Cigna network. You will pay out of pocket for out-of-network care, except for medical emergencies. Because of this, before visiting a new provider or facility, confirm that they participate in the Endeavor Health or Cigna network.

Deductibles Explained

Deductibles do not always work the same. If you cover just yourself as the subscriber, it’s straightforward and they work the same no matter which plan you choose. When you cover other family members, there are some differences from plan to plan that are important to know about.

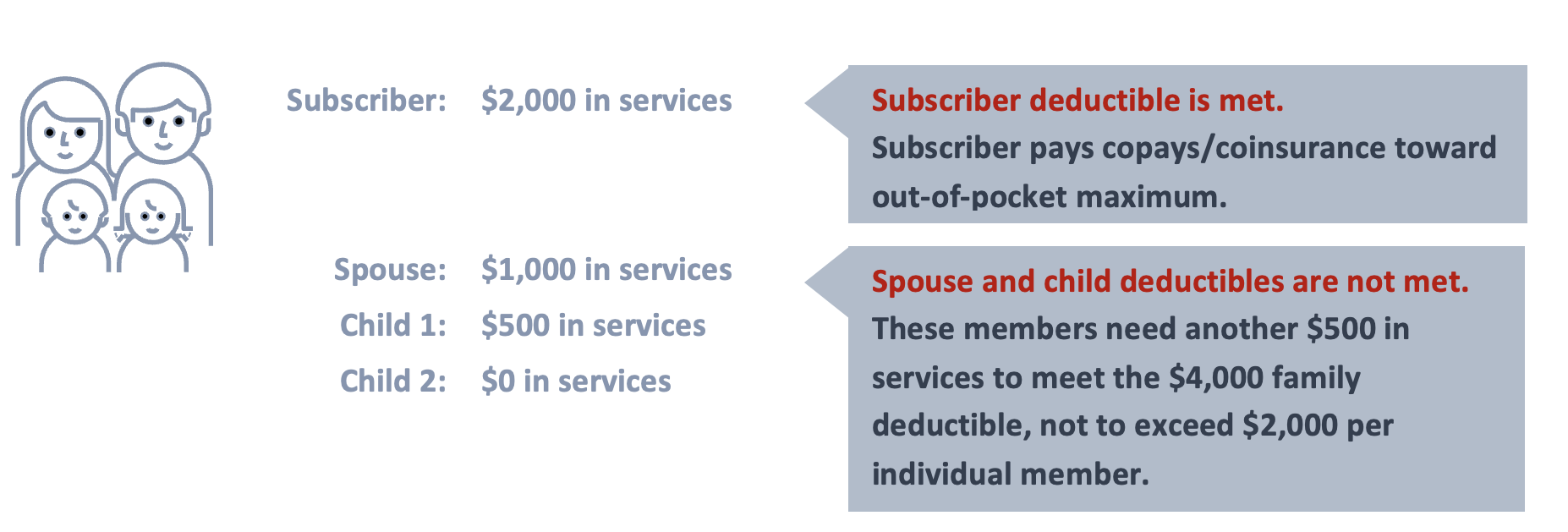

System and EPO Plans (embedded deductible):

Expenses for each covered family member are based on the individual amount. When one person meets the individual deductible, the health plan begins paying its share of expenses for just that family member. When several different family members have each paid enough in individual deductibles that, added together, the family deductible has been met, the plan begins paying its share of the health care expenses for the entire family.For example, if you have a $2,000/$4,000 (single/family) embedded deductible, here’s how your plan would work:

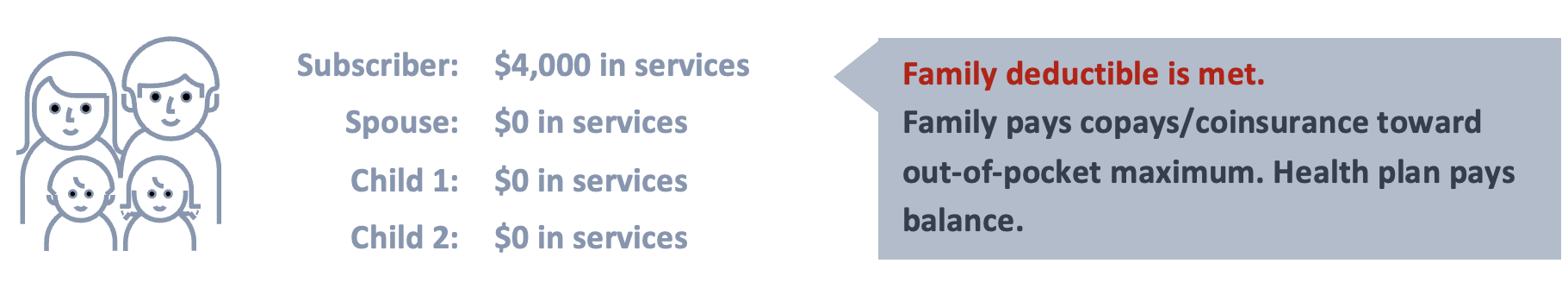

HDHP (true family deductible):

The combined total of the family’s expenses must be met for the health plan to cover its share of the expenses for the entire family. If one member of the family has health care expenses high enough to meet the family’s deductible, the plan will pay its share of expenses for the entire family even though only one family member met the deductible.

For example, if you have a $2,000/$4,000 (single/family) aggregate deductible, here’s how your plan would work:

Find a Provider

If you have questions finding or verifying a provider, use the contact information provided below.

Call Cigna at:

Use this link to find providers and facilities covered by the NS-EEH System Plan.

Click here for Providers in the Cigna Network

Use this link to find additional providers and facilities covered by the High Deductible Health Plan (HDHP) and Exclusive Provider Organization (EPO) Plan.

How To Search For Cigna Behavioral Providers