Major injuries are painful. But the financial impact of the medical treatment doesn’t have to be.

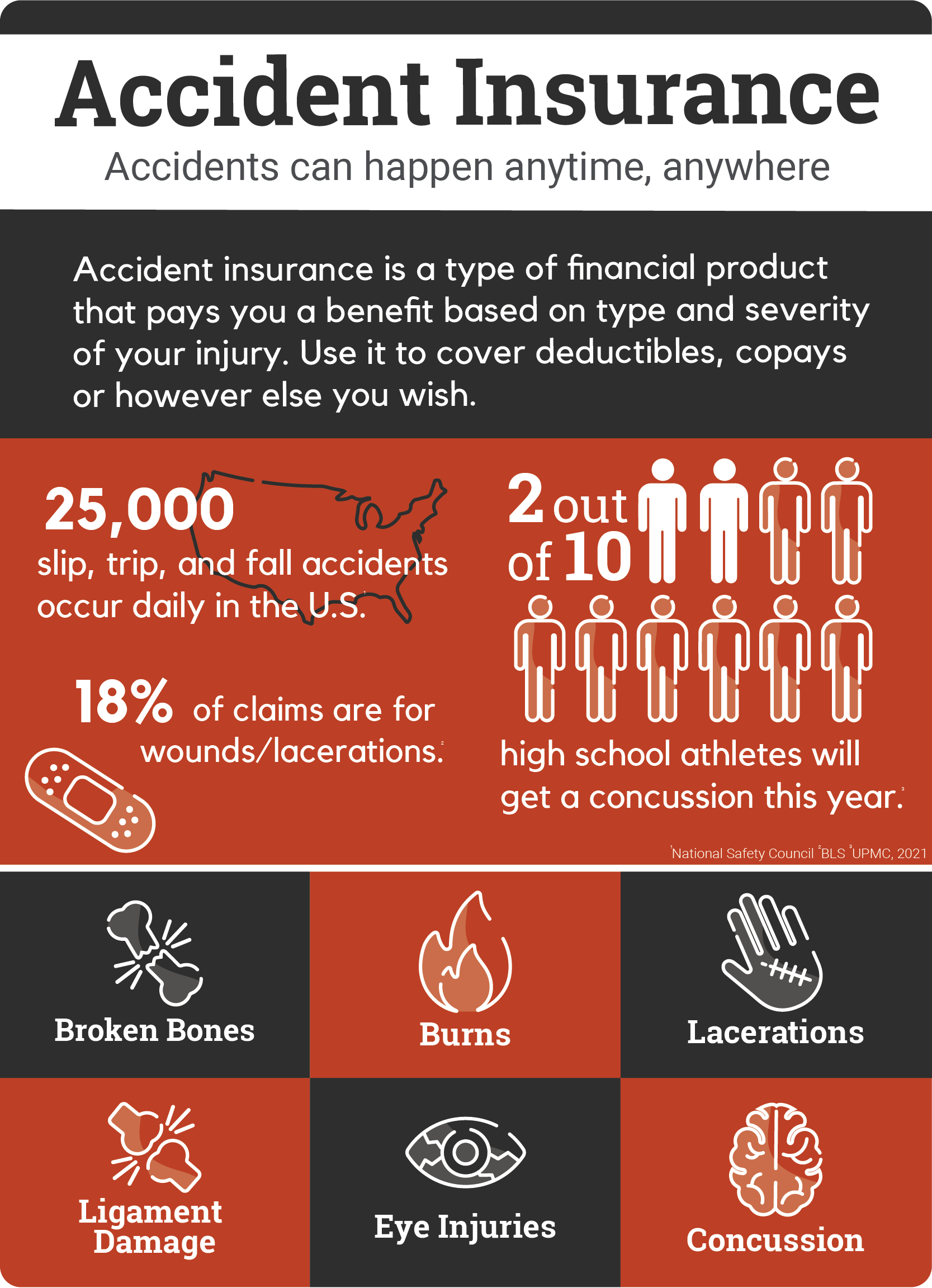

Accidents happen. You can’t always prevent them, but you can take steps to reduce the financial impact, which is often substantial. Accident Insurance can help cover the out-of-pocket medical expenses and extra bills that can follow an accident (on or off the job) by paying benefits for specific injuries and events resulting from a covered accident. The benefits paid under this plan do not replace or offset benefits paid by your medical plan.

The total benefit you receive is based on the type of injury, its severity, and the medical services you received in treatment and recovery.

The plan pays benefits for a variety of injuries and accident-related expenses, including:

- Fractures and Dislocations

- Lacerations

- Hospitalization

- Physical Therapy

- Emergency Room Treatment

- and more...

Plan Features

- Portable Coverage - You can take your policy with you if you change jobs or retire.

- Family Coverage - You can elect to cover your spouse and children.

- 24/7 Coverage - Benefits are paid for accidents that occur on and off the job.

The policy or its provisions may vary or be unavailable in some states. The policy has exclusions and limitations which may affect any benefits payable.

Accident Insurance is a limited benefit policy. It is not health insurance and does not satisfy the requirement of minimum essential coverage under the Affordable Care Act.