Always be there financially for your loved ones.

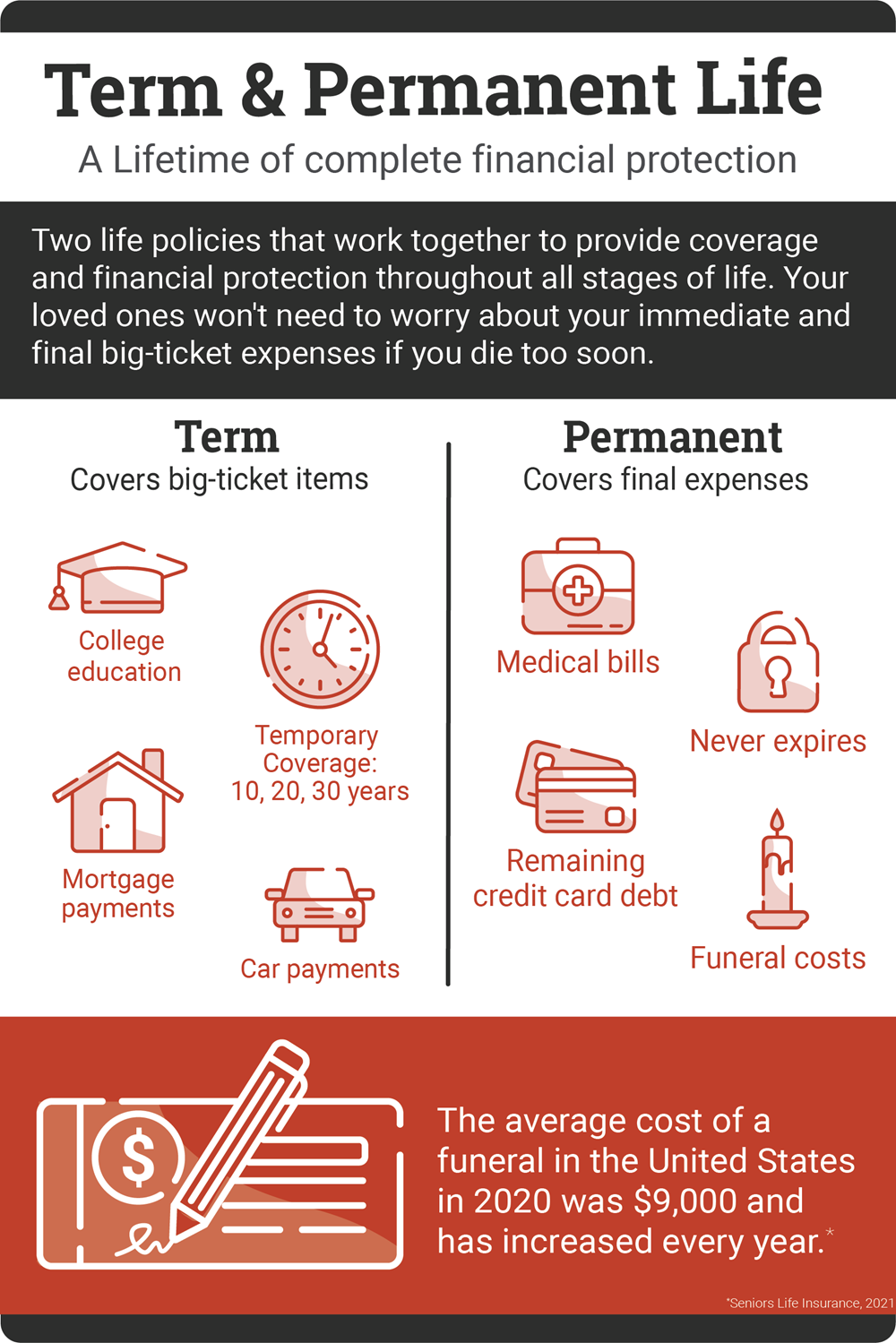

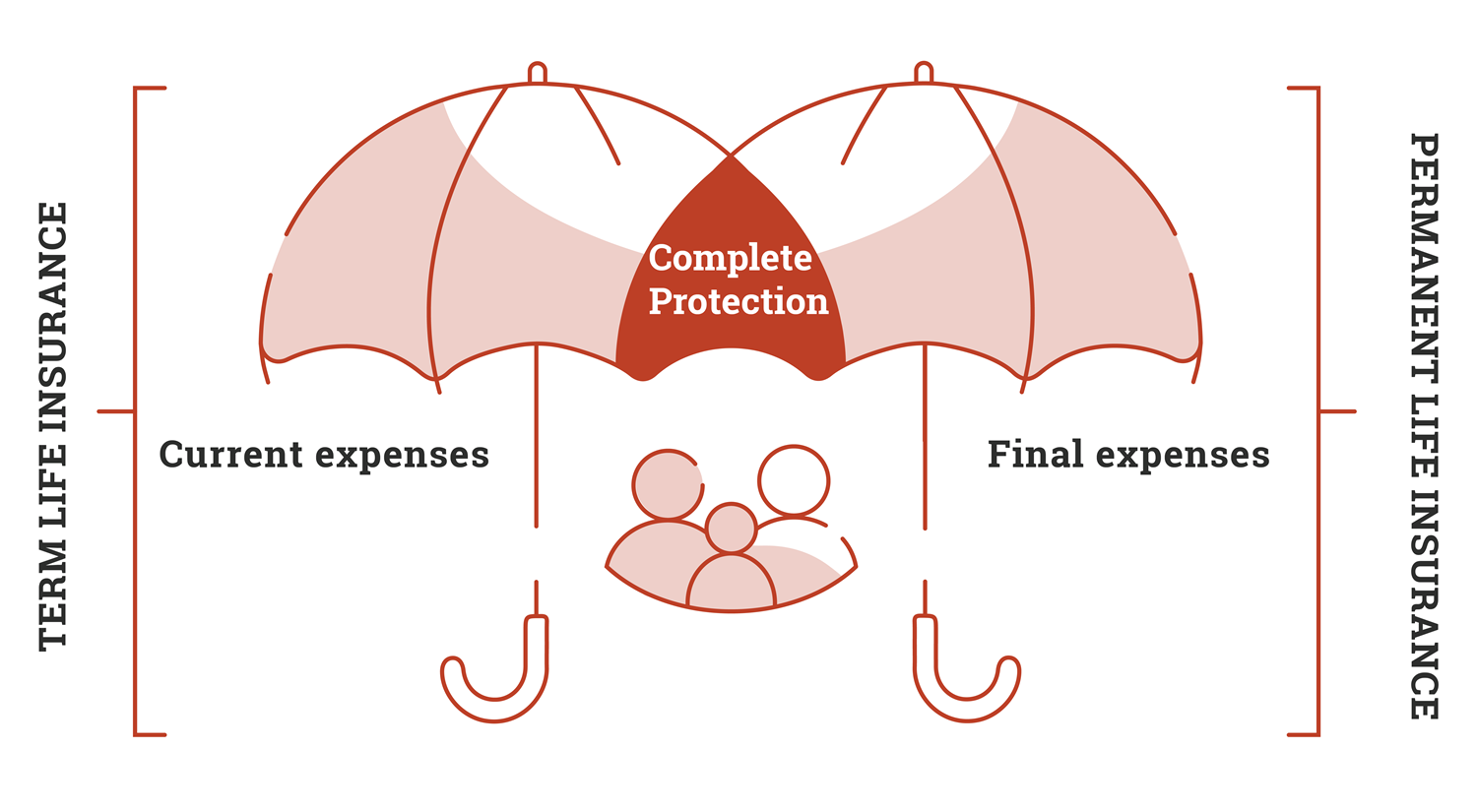

One policy with two benefits. Whole Life Insurance provides a benefit to your loved ones

that they can use to cover expenses such as funeral costs, shared credit card debt, and

unpaid medical bills. If you need long-term care, you can access a portion of your Life Insurance to help you pay for your long-term care expenses such as a home health care worker, long-term care facility, or a nursing home.

Unlike Term Life Insurance, Permanent Life is 100% portable and premiums are guaranteed level. This means you can take the benefit with you if you change jobs or retire, and the cost and coverage remain the same.

You can purchase coverage for yourself, your spouse and your children. Coverage is guaranteed issue – no proof of good health required – if you enroll when you are first eligible.

Permanent Life Insurance

- Family Coverage - You can purchase coverage for yourself, your spouse, your children, and/or your grandchildren.

- Portable Coverage - This policy is portable, which means you can take it with you even if you leave Nuvance (though the premium will no longer be paid through your payroll deduction).

- 24/7 Coverage - Acceptance is guaranteed. No medical exams are required if you choose this coverage when initially offered.