Save for future medical costs and reduce your tax bill with this special savings account available to CDHP participants.

A Health Savings Account, or HSA, is a special tax-advantaged savings account set up specifically for you and your family. This account is automatically set up when you enroll in the Choice or Choice Plus medical plan options, but you MUST provide documentation for the account to be activated. You may pay for health-related expenses (like doctor visits and hospital services) out of your HSA.

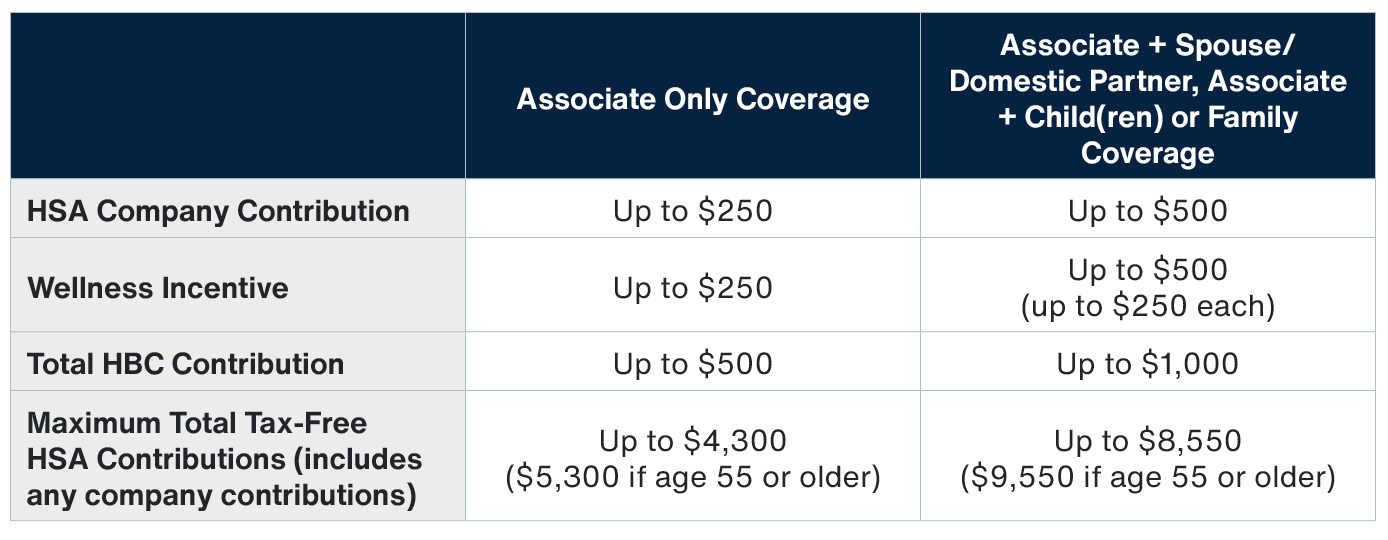

When you enroll in the Choice or Choice Plus plans, SFA will make an initial contribution to your HSA. You will also have the opportunity to earn a Wellness Incentive contribution by completing wellness requirements.

The HSA is administered by Optum Bank through WEX.

Optum and WEX have collaborated to provide integrated, seamless HSA administration. You will now have 24/7 web access for online claims processing, direct deposit reimbursement, online bill pay, and electronic statements - all through optumbank.com.

Keys to Growing Your HSA:

Try not to use your HSA for routine expenses. If you can pay out-of-pocket, leave your HSA funds alone so that they can grow for when you need them in the future.

Consider electing supplemental medical benefits to cover big ticket expenses from unexpected serious illnesses or injuries and ensure they don’t wipe away the money in your HSA.

Monitor your fund’s growth. Like a 401(k), your HSA funds earn interest through investments. Make sure your money is growing at an acceptable and safe pace.

*Associates and/or spouses/domestic partners must complete a Health Risk Assessment and an annual exam to be eligible for the Wellness Incentive. If you cover a spouse/domestic partner on an HBC medical plan, you can both complete the requirements on an individual basis to be eligible for the Wellness Incentive, independent of one another. Wellness Incentive HSA contributions are available to Associates enrolled in the Choice Plus or Choice plan.

**For 2025: $4,300 for single coverage; $8,550 for family coverage; plus an additional $1,000 “catch up” contribution for individuals age 55 and older.

Optum HSA Information

HSA On-Demand Webinars

HSA Videos

HSA Triple Tax Advantage

Pre-Tax Contributions

- Associate contributions through payroll are made on a pre-tax basis through the Section 125 cafeteria plan. Associate contributions outside of payroll receive an above-the-line tax deduction for federal tax purposes.

- Employer contributions are tax-free to the Associate for federal tax purposes.

Tax-Free Growth

- HSA gains are not subject to interest, dividend, or capital gains taxes.

Tax-Free Distributions

- Distributions for qualifying medical expenses are not subject to taxation.

HSA Eligibility

To be eligible to qualify for an HSA, you must also meet the following requirements:

- You are not covered by any other non-HDHP health plan, such as a spouse's plan, that provides benefits covered by your CDHP.

- You are not enrolled in Medicare.

- You do not receive health benefits under TRICARE.

- You cannot have received medical benefits from Veterans Administration (VA) for any non-service-connected disabilities at any time during the previous three months.

- You cannot be claimed as a dependent on another person's tax return.

- You are not covered by a general purpose health care flexible spending account (FSA) or health reimbursement account (HRA). Alternative plan designs such as a limited-purpose FSA are permitted.

Investing Your HSA

How can I make changes?

You can elect and make changes to your HSA benefits through your Enrollment Portal anytime through the year.

Contact