Reduce your income taxes while putting aside money for health and dependent care needs.

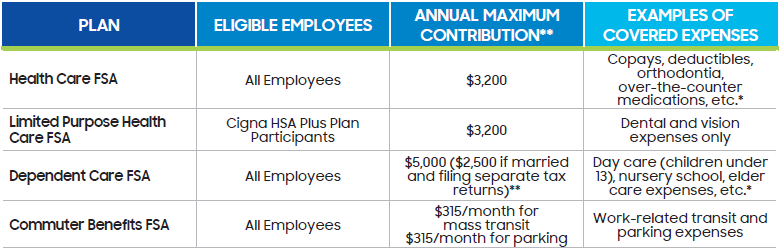

Flexible Spending Accounts (FSAs) enable you to put aside money for important expenses and help you reduce your income taxes at the same time. SRA offers a Health Care FSA, a Limited Purpose Health Care FSA, a Dependent Care FSA, and a Commuter Benefits FSA. These accounts, administered by Optum Financial, allow you to set aside pre-tax dollars to pay for certain out-of-pocket health care, dependent care, or commuting expenses.

Please note: These accounts are separate. For example, you cannot use money from the Health Care FSA to cover expenses eligible under the Dependent Care FSA or vice versa.

Use-it-or-lose it!

IRS legislation allows for $640 of account funds to carry over from 2024 Health Care FSAs. Funds in excess of this amount will be forfeited.

Health Care FSA, Limited Purpose Health Care FSA, & Dependent Care FSA

- During your enrollment, you decide how much to set aside for health care and/or dependent care expenses.

- Your contributions are deducted from your paycheck on a before-tax basis in equal installments throughout the calendar year.

Commuter Benefits FSA

- Every month, you choose how much to set aside for monthly qualified, work-related, transit and parking expenses.

- Choose how much tax-free money to set aside for monthly qualified, work-related transit and parking expenses by the 10th of every month.

* See IRS Publications 502 and 503 for a complete list of covered expenses.

**Please read the "Flexible Spending Account (FSA) Contributions for Highly Compensated Employees" section below, if you have not done so already.

**Flexible Spending Account Contributions for Highly Compensated Employees

The Internal Revenue Code (IRC) allows pretax contributions to FSAs as long as the benefit does not favor highly compensated employees (HCEs). You are considered “highly compensated” if your gross earnings are above the annual amount set by the Internal Revenue Service.

In accordance with IRC regulations, North America Samsung Electronics Corporation (NA SEC) examines Dependent Care FSA elections each year to ensure that the benefit does not disproportionately benefit HCEs and that the Plan remains compliant. If the benefit is found to “discriminate” against non-highly compensated employees, NA SEC subsidiaries will reduce contributions made by HCEs to a level that enables compliance with the IRC. If the Dependent Care FSA fails the test for the year, HCEs will be taxed on the pretax deductions contributed to their Dependent Care FSA during that calendar year.

Non-highly compensated employees are not affected by this rule.

As you plan your Dependent Care FSA election for the year, please consider the following:

- Depending on your income, it may be more advantageous to take a Tax Credit when filing your income tax return than paying your expenses through a pre-tax Dependent Care FSA.

- For HCEs, it may be advantageous to plan how you might share the maximum $5,000 Dependent Care FSA with your spouse if your spouse has access to a similar benefit.

Please consult a qualified tax advisor on the matter.