Health care needs are different for everyone. Our medical plan offers multiple options so you can choose the coverage level best-suited to your needs and budget.

SFA offers three different medical plan options through Cigna. All of the available options give you access to Cigna's Open Access Plus (OAP) network and offer high-quality, comprehensive care. The Open Access Plus network is Cigna's broad seamless national network. The plans differ in the way the cost of care is structured and in the strategies that you can use to control your expenses:

Cigna Choice (CDHP)

The consumer driven health plan (CDHP) offers an all-in-one approach to health care. These plans use high deductibles coupled with tax-advantaged Health Savings Accounts (HSA) and lower premiums to help you better control your health care spending.

Cigna Choice Plus (CDHP)

The Cigna Choice Plus plan offers both In-Network and Out-of-Network benefits, allowing you additional coverage if you elect to see a provider outside of Cigna's Open Access Plus network. The Choice CDHP Plan provides you in-network only coverage with Cigna's largest nationwide network.

Cigna PPO

The Cigna PPO plan are traditional plans that give you the greatest flexibility, combined with lower costs when you choose a provider within Cigna’s broad national network. Choosing health professionals who participate in Cigna's Open Access Plus network will help keep your costs lower and eliminate paperwork.

Networks

You can always reference what Cigna network you're using by checking your ID card or looking on www.myCigna.com. The correct network for those who reside in California is Select Plus, and the network for those who reside outside of California is Choice Plus.

MyCigna Portal

myCigna.com

Get the most out of your health plan by activating your account on myCigna.com. The secure member portal provides 24/7/365 live support and access to all details of your plan and more:

- Find in-network doctors, care, and cost estimates

- Access verified patient reviews from other Cigna members

- Connect with virtual care (telehealth) providers, 24/7

- Print or view your Cigna ID card

To activate your account be sure you have your Cigna ID number, the subscriber's Social Security number or another form of identification.

myCigna App

Download the myCigna app for instant access to your health care data. To download the app:

- Launch the myCigna App or go to myCigna.com and select “Register Now”

- Enter your personal information

- Confirm your identity

- Create your security information and provide your primary email address for enhanced security protection and notifications

- Review, then select “Submit”

For more information, visit myCigna Mobile app overview.

Plan Comparison Chart

Click below to compare our Cigna plans to ensure you select the one that is best for you and your family.

2025 Summary of Benefits and Coverage

2025 Summary Plan Description

TeleHealth

When you need medical advice, but don’t have the time or want the cost associated with a trip to the doctor’s office, video visits are available through MDLIVE. These can be done in just minutes with no travel time. It’s quick, convenient, and saves you money.

Doctors are available to treat many common medical conditions at times that are convenient for you. Learn more. When and how to use MDLIVE.

Get Care For:

- Cold, flu, and sinus infections

- Nausea and vomiting

- Asthma, allergies, and rashes

- Urinary tract infections

- Headaches and migraines

- Stress and anxiety

- Insomnia, depression, and mood swings

- Trauma and grief counseling

Wellness Incentive

Wellness incentive employer contributions will be made to your Flexible Spending Account (FSA) if you are enrolled in the Cigna PPO medical plan or into your Healthcare Savings Account (HSA) if you are enrolled in either the Choice Plus CDHP or Choice CDHP medical plans.

To be eligible for the full wellness incentive, you must complete:

- Health Risk Assessment: Become aware of ways to enhance you personal health and well-being through the completion of your confidential Health Risk Assessment (HRA);

- Physician Engagement: Engage with your personal physician through an annual wellness visit

Visit the Wellness Incentive page to learn more!

Cigna Medicare Concierge Services

When the time comes to start considering Medicare, the options can be overwhelming. Should you continue SFA coverage or consider full Medicare benefits even if you choose to work? Cigna's Medicare Concierge Services can help eligible Associates navigate the health plans best for them - at no cost to you.

Medicare Options:

- Medicare doesn't have to be confusing.

- Be informed about the many Medicare options that are available.

- Licensed Benefit Advisors can provide specific details on Medicare Advantage plans, Medicare Part D, drug plans and Medicare Part D, drug plans and Medicare Supplement plans (Medigap) so you can make a well-informed decision.

Visit www.CignaMedicare.com or call 1-866-317-4116 Monday - Friday from 8:30am to 8:30pm (EST).

Medicare Medical Concierge

Cigna Medicare Concierge Virtual Seminar

MyCigna Portal

myCigna.com

Get the most out of your health plan by activating your account on myCigna.com. The secure member portal provides 24/7/365 live support and access to all details of your plan and more:

- Find in-network doctors, care, and cost estimates

- Access verified patient reviews from other Cigna members

- Connect with virtual care (telehealth) providers, 24/7

- Print or view your Cigna ID card

To activate your account be sure you have your Cigna ID number, the subscriber's Social Security number or another form of identification.

myCigna App

Download the myCigna app for instant access to your health care data. To download the app:

- Launch the myCigna App or go to myCigna.com and select “Register Now”

- Enter your personal information

- Confirm your identity

- Create your security information and provide your primary email address for enhanced security protection and notifications

- Review, then select “Submit”

For more information, visit myCigna Mobile app overview.

Cigna Resources

Care Outside of the U.S. - When traveling outside of the country, on business or pleasure, no one wants to think about a medical emergency. But when it happens, Cigna has you covered.

Health Disparities - Find information and resources to reduce health differences that are closely linked with social or economic disadvantage in patients.

The Body and Mind Connection - Screening tools, reimbursement, and patient resources for the valuable time you spend with your patients talking about emotional health.

Virtual Visits - Telemedicine service provides the 24/7 convenience of seeking non-urgent medical care from your home or office without an appointment.

- Virtual visits can be done through a computer via mycigna.com or a mobile device with the Cigna mobile app. Learn More.

Preventive Care - What is preventive care and what services are covered?

Cigna also offers a variety of lifestyle and disease management programs to help you and your dependents improve your health and well-being.

- Omada Health: a digital lifestyle change program designed to help you and your dependents lose weight, gain energy and reduce the risk of type 2 diabetes and heart disease. Learn more at: www.Omadahealth.com/HBC

- Your Health First: Cigna's chronic condition coaching program for members with the following chronic conditions: asthma, heart disease, diabetes, lower back pain, COPD, osteoarthritis, anxiety, depression, bipolar disorder.

Care Management

Cigna offers care management programs to help you and your dependents get healthy and live well. If you are going through a complex health condition, Cigna may reach out to you in order to provide one-on-one support such as helping lower your out-of-pocket expenses, prepare for medical appointments, and assist with understanding healthcare bills. You may also reach out to Cigna to enroll in a qualifying care management program.

Behavioral Health

Cigna offers comprehensive behavioral health programs through dedicated support for you and your covered dependents. You can receive unlimited in-the-moment consultations, guided navigation to help you find in-person and virtual care options and 100% follow up after your initial behavioral consultations to ensure you received the care you need. Learn more about the Behavioral Health Program.

Virtual Care: Access a licensed psychiatrist or counselor by phone or video through our virtual behavioral network through myCigna.com. Cigna contracts with Talkspace, Headspace Care (formerly known as Ginger); Monument, Brightside and many more. List of Behavioral Virtual Providers.

Care Management: Our Behavioral Specialty coaches can provide dedicated support for a broad range of conditions, which includes: Autism Spectrum | Eating Disorders | Intensive Behavioral Case Management | Opioid and Pain Management | Substance Abuse.

Behavioral Health Seminars: Monthly seminars available to the public, these resources are available to all SFA Associates and their families.

Medical Glossary

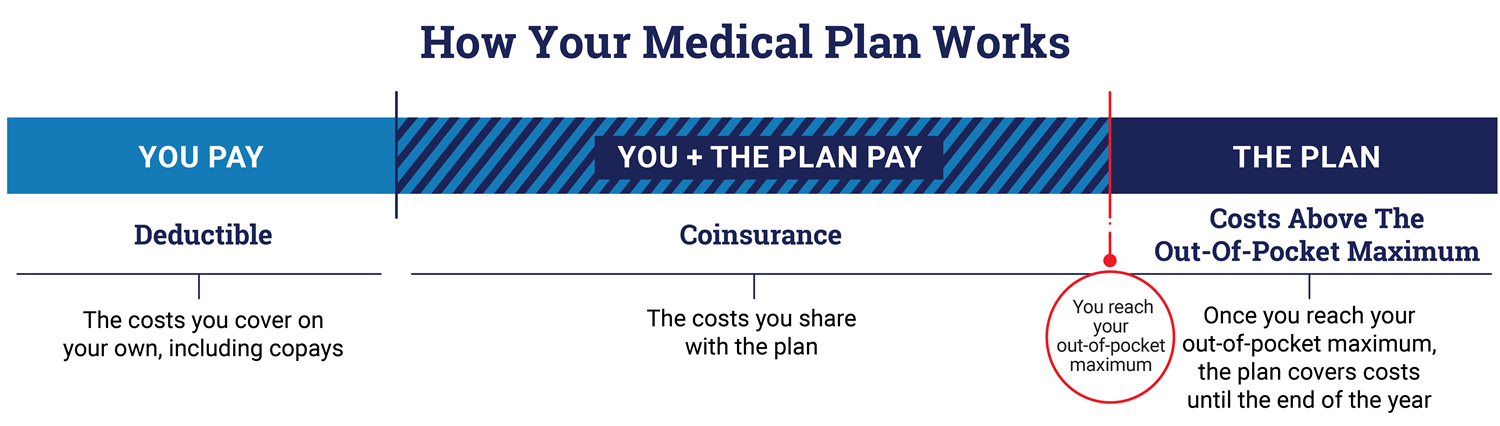

Deductible - The amount you must pay for medical services, before the plan pays a benefit. Preventive care is always covered at 100% with no deductible required.

Coinsurance - This is the percentage of the cost you pay for certain services after the deductible has been met. You can think of this as “cost sharing.” For example, once your deductible has been met you could pay 20% for the cost of certain services and the plan could pay 80%.

Copay - The flat fee paid by the member when a medical service is received, i.e. $20 for a doctor's visit or $20 for a prescription.

In-Network Provider - An in-network provider is a hospital, doctor, medical group, and/or other healthcare provider contracted to provide services to insurance company customers for a discounted fee. Using these providers will lessen your medical expenses when using your benefits.

Out-of-Network Provider - An out-of-network provider is a hospital, doctor, medical group, or other healthcare provider who is not contracted to provide services to insurance company customers. Because the fees are not negotiated in advance with the insurance company, the provider can charge the member as much as they wish.

Out-of-Pocket Maximum - The maximum amount a member would have to pay out of their pocket for medical expenses for the year, with the exception of benefit premiums (which come out of your paycheck). Your out-of-pocket maximum includes your deductible, any coinsurance paid and all copayments (medical and prescription drug).

Contact