Life insurance pays a benefit in the event of your death. AD&D provides you specified benefits for a covered accidental death or bodily injury that directly causes dismemberment (i.e., the loss of a hand, foot or eye).

Nobody likes to think about it, but think about what expenses and income needs your dependents would have if something happened to you—especially if you provide most of the income for your family. Learn more about your life insurance options and how much coverage you might need at securian.com/amedisys-life.

What’s the difference?

- Life insurance pays a benefit in the event of your death.

- AD&D provides you specified benefits for a covered accidental death or bodily injury that directly causes dismemberment (like the loss of a hand, foot or eye).

We cover the basics

Amedisys provides full-time, part-time eligible and Baylor team members with basic life coverage of one times your annual base benefits rate (ABBR), rounded up to the next $1,000, with a new minimum of $50,000 up to a maximum of $300,000. In addition, Amedisys provides $2,000 in basic life coverage for your eligible dependents at no cost to you!

Name your beneficiaries online

Securian Financial will manage all beneficiaries for your life insurance benefits through Amedisys. Designate a beneficiary to ensure your benefits are paid as you intend. To designate your beneficiary online:

- Visit LifeBenefits.com.

- Enter your user ID, which is “amed” followed by your 8-digit employee ID number.

- Enter your password, which is your 8-digit date of birth (MMDDYYYY) followed by the last 4 digits of your Social Security Number. After you log in for the first time, you will be prompted to set a new password for any future return visits to the site. You can use these same credentials to both update your beneficiaries and complete the Evidence of Insurability (EOI) process online, as needed.

Quick Tip

Your Annual Base Benefits Rate (ABBR)* is:

- Salaried: Your Annual Base Salary

- Hourly: Your Base Hourly Rate × 40 hours a week × 52 weeks

- Per Visit: Your Weekday Per Visit Rate × 30 visits a week × 52 weeks

*ABBR for social workers is based on 20 visits per week. ABBR for part-time eligible team members is based on standard scheduled hours per week.

You decide if you want more bang for your bucks

Life insurance pays a benefit in the event of your death.

If you are an eligible team member, you may purchase additional group term life and AD&D insurance for yourself and your eligible spouse or child(ren). You must purchase voluntary employee life insurance for yourself if you wish to purchase voluntary life insurance for your spouse.

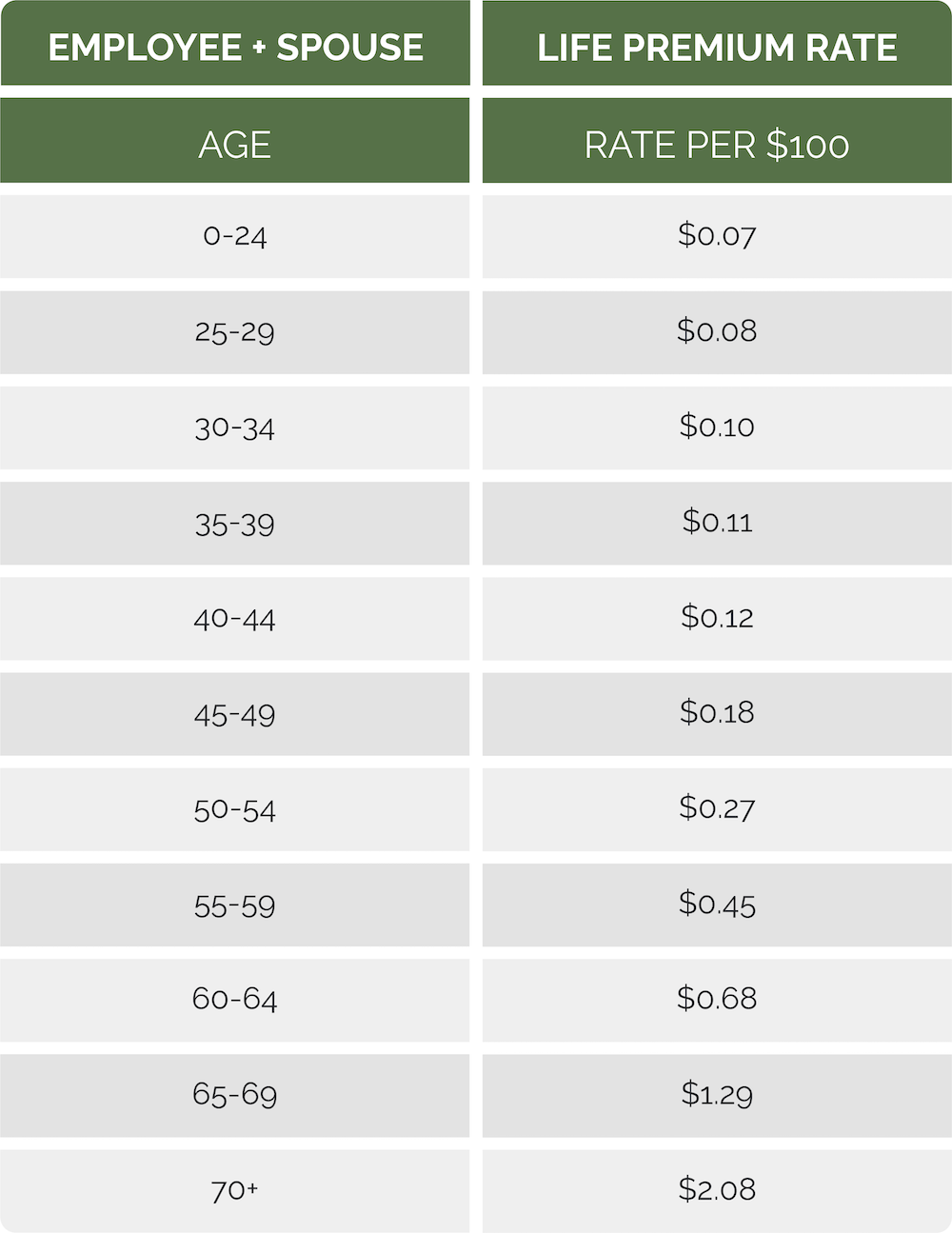

Calculate Your Life Insurance Cost:

Your Coverage Amount: $_________ ÷ 1000 x Premium Rate = Your Monthly Cost

See chart below for Premium Rate

What is EOI?

If you request an increase in employee or spouse coverage, you will need to complete the Evidence of Insurability (EOI) process with Securian Financial. It's a simple, secure process that can be completed online. Here's how:

- You will receive an email and/or letter from Securian about 2 weeks after you enroll.

- Follow the instructions to setup your LifeBenefits account online.

- Provide your height and weight and answer three short questions which will determine whether additional medical history is needed.