Eligibility

Team member eligibility date is the first of the month after completing one month of employment. Eligible team members may defer from 1% to 80% of their compensation on a pre-tax 401(k) or after-tax Roth basis. If you do not make an election, you are automatically enrolled at 4% pre-tax. If you prefer to make after-tax Roth deferrals, you must contact Fidelity and make an election.

Match

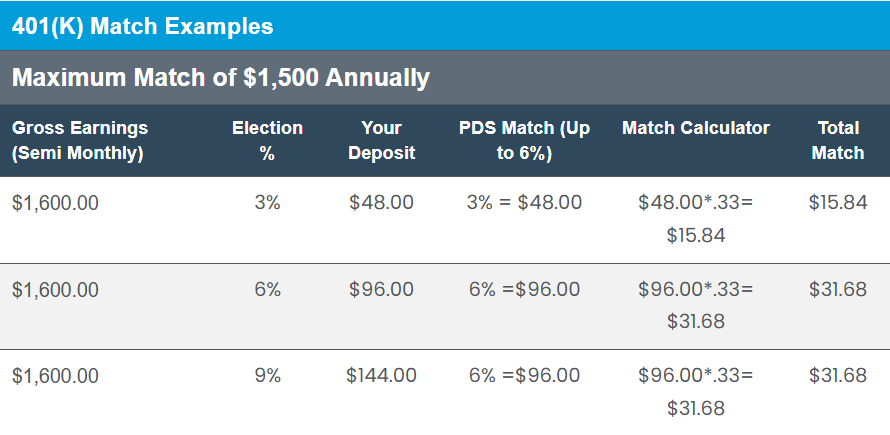

PDS Health offers a discretionary match. The current matching formula is ($0.33) on the dollar, up to the first 6% of compensation you defer as 401(k) and/or Roth. The discretionary match will not exceed $1,500 per calender year.

Rollovers from other plans are allowed. Rollovers of Roth IRAs or IRAs to which you made non-deductible contributions are not allowed.

Vesting

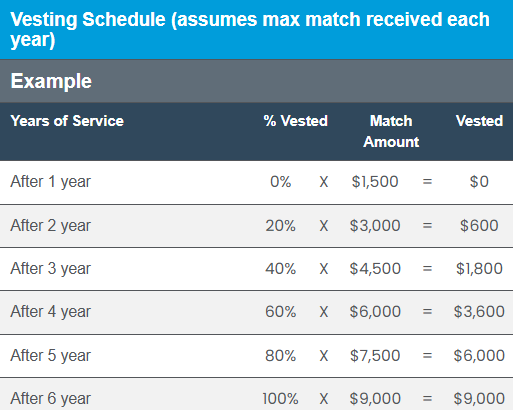

A year of service for vesting means that you worked 365 days from your date of hire or rehire.

The 2025 annual deferral limit, set by the IRS, is $23,500. This limit is a combination of any 401(k) and/or Roth deferrals that you make. If you will be age 50 or older by December 31, 2025, you may make an additional “catch-up” contribution of up to $7,500. Please visit irs.gov for updated yearly deferral limits.

Team member contributions are always 100% vested. Any matching contributions are subject to the schedule below.

Distributions and Loans

You may withdraw funds in the event of termination of employment, retirement (age 65), death or permanent disability. In-service withdrawals are available if you have attained age 59 1/2 or have a qualified financial hardship (restrictions apply). You may withdraw all or a portion of any Team Member Rollover Contribution account at any time. To request a withdrawal, please contact Fidelity Toll Free at (800) 835-5095.

You may borrow up to 50% of your vested account balance or $50,000, whichever is less. The minimum loan available is $1,000.

Repayment is made through payroll deduction at a fixed interest rate of the Prime Rate plus 1% as determined at the time of the loan. The maximum term of the loan is 59 months unless the proceeds are used to purchase a principal residence. The maximum term of a loan to purchase a principal residence is 15 years.

To request a loan, please contact Fidelity Toll Free at (800) 835-5095 or access your account via their website at netbenefits.com.

Obtain information about the investment options by accessing your account on Fidelity’s website netbenefits.com, or by contacting Sageview Advisory Group.

Sageview Advisory Group can be contacted at (800) 814-8742 for the following:

- Enrollment guidance

- Assistance with your investment options

- Assistance with rollover contributions

To speak with a SageView Certified Financial Planner call (833) SAGE-411.

PDS Health 401(k) Plan

Eligible automatic contribution notice. This notice contains important information regarding your participation in the plan.Automatic contributions

The Plan includes a feature know as an Eligible Automatic Contribution Arrangement (“EACA”). Under the EACA provisions of the Plan, the Employer will automatically withhold a portion of your compensation from your pay each payroll period and contribute that amount to the Plan as a pre-tax 401(k) deferral. If you wish to defer the automatic deferral amount of 4% you do not need to make a deferral election. However, if you want to defer a different percentage or do not want to defer at all, then you must make that alternative election within a reasonable time after you receive your enrollment notification from Fidelity, and before the first automatic deferal.

However, if you want to defer a different percentage or do not want to defer at all, then you must contact Fidelity to make that alternative election. There will be a 30-day enrollment period beginning after you receive the automatic contribution notice from Fidelity before your automatic contribution will begin.

Automatic increase

The initial automatic deferral amount of 4% will increase January 1 of each year by 1% of compensation per year up to a maximum of 10%.

Limited right to withdraw automatic deferrals

If your Employer automatically enrolled you and you did not want to participate in the Plan, you may elect to have the Plan distribute to you all of your prior automatic deferrals (adjusted for any earning or losses). You may make this election on the form provided to you by the Plan Administrator. You must make this election no later than 90 days after the first automatic deferral is taken from your compensation. If you elect to withdraw your automatic deferrals, then the entire amount will be subject to income taxes, but you will not be subject to the 10% premature distribution penalty tax, even if you receive the distribution prior to age 59-1/2. Also, if you withdraw your prior automatic deferrals, then you will forfeit any matching contributions related to those deferrals. If you take out automatic contributions, then the Employer will treat you as having chosen to make no further deferrals until you subsequently complete a salary deferral agreement.

If you have questions regarding the enrollment process, or for questions regarding your specific benefits, contact a Benefits Advocate at (877) 536-8693 or pdsbenefits@aon.com, M-F 6:00 am to 4:00 pm PT.

Important Notice: This site provides information about the benefits and coverages that are available across the benefit plans maintained by PDS Health (“PDS®”) and by its PDS Supported Entities. This site applies to all team members. The term “team member” in this site refers to you, whether your employer is PDS® or a PDS Supported Entity. When the term “plan” or “Plan” is used in this site, it refers to the benefit plans that each employer makes available to its team members.

This site provides a general description of your employer’s benefits, and it serves as a summary of material modifications to the ERISA-required Summary Plan Descriptions applicable to these benefits (e.g., benefit booklet or evidence of coverage). This site does not describe all terms and conditions that may apply to your benefits. Details, including terms, limitations, and other conditions are provided in the ERISA plan document. If the information in this site differs from the ERISA plan document or Summary Plan Descriptions, then the ERISA plan document and Summary Plan Descriptions should prevail, as applicable.

(800) 835-5095

(800) 835-5095