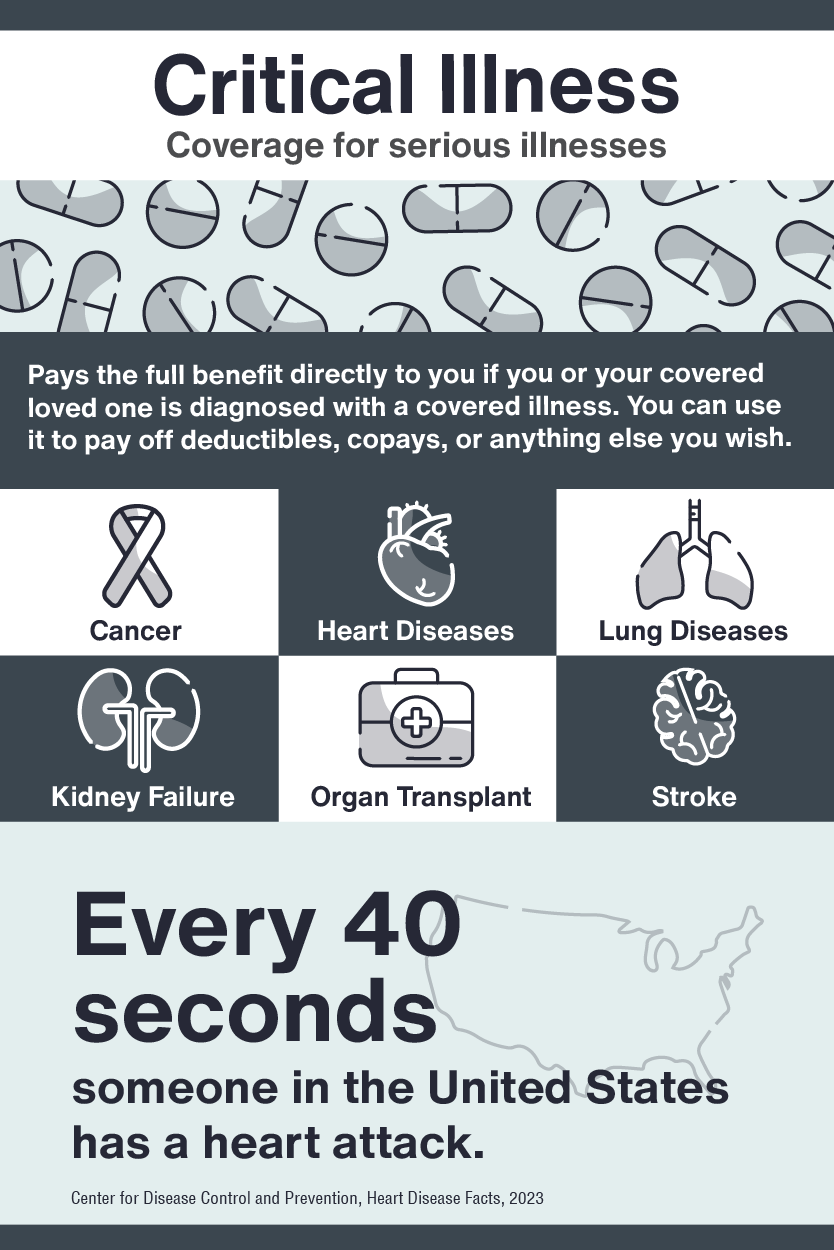

Critical Illness Insurance is designed to help participants offset the financial effects of a catastrophic illness with a lump sum benefit if an insured is diagnosed with a covered Critical Illness. The Critical Illness benefit is based on the amount of coverage in effect on the date of diagnosis of a Critical Illness or the date treatment is received according to the terms and provisions of the policy.

Examples of Covered Diagnoses Include:

- Stroke

- Cancer

- Heart Attack

- Coma

- Paralysis

- Brain Injury

Additional Benefit Highlights

- Wellness Benefit of $75 for each family member

- Portability – you own the policy so you can keep it even if you leave the company or retire

- Dependent Coverage – cover yourself, your spouse or your child(ren)

- Convenient payroll deduction

Regular full-time team members can enroll in the Critical Illness plan within 30 days from their date of hire and during an annual enrollment period. During your initial eligibility, you are guaranteed enrollment into the Critical Illness plan. If you elect to enroll at a subsequent enrollment period, an approval process will apply.

Note: Team member must be covered to purchase spouse coverage and spouse coverage must equal team member coverage.

For more details on benefit coverage and cost, refer to the Unum flyer.

If you have questions regarding the enrollment process, or for questions regarding your specific benefits, contact a Benefits Advocate at (877) 536-8693 or pdsbenefits@aon.com, M-F 6:00 am to 4:00 pm PT.

Important Notice: This site provides information about the benefits and coverages that are available across the benefit plans maintained by PDS Health (“PDS®”) and by its PDS Supported Entities. This site applies to all team members. The term “team member” in this site refers to you, whether your employer is PDS® or a PDS Supported Entity. When the term “plan” or “Plan” is used in this site, it refers to the benefit plans that each employer makes available to its team members.

This site provides a general description of your employer’s benefits, and it serves as a summary of material modifications to the ERISA-required Summary Plan Descriptions applicable to these benefits (e.g., benefit booklet or evidence of coverage). This site does not describe all terms and conditions that may apply to your benefits. Details, including terms, limitations, and other conditions are provided in the ERISA plan document. If the information in this site differs from the ERISA plan document or Summary Plan Descriptions, then the ERISA plan document and Summary Plan Descriptions should prevail, as applicable.