PDS Health and its supported offices offer Flexible Spending Account (FSA) benefits, with Navia Benefit Solutions, which allow regular full-time team members to set aside pre-tax dollars for health care and dependent care expenses.

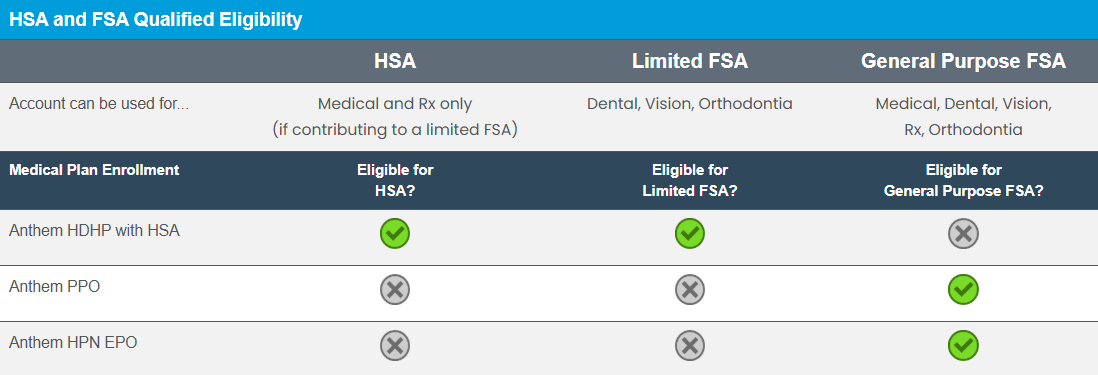

If you participate in a HSA, you may enroll in a Limited Healthcare FSA. For the 2025 Plan year, you may set aside up to $3,200 pre-tax, per year, to pay for eligible dental, vision and orthodontia expenses.

Healthcare FSA

This program allows team members to pay for certain IRS-approved medical care expenses with pre-tax dollars. The 2025 Plan Year maximum you may contribute to the Healthcare FSA is $3,200.

- For those team members who enroll in a HSA Plan, you may participate in the Limited Healthcare FSA, which reimburses for dental, vision, and orthodontia expenses. IRS regulations prohibit participation in a General Purpose Healthcare FSA when you are making contributions to a HSA Account.

- For those team members who do not enroll in the HSA Plan, you may participate in the General Purpose Healthcare FSA, which reimburses for medical, dental, vision, orthodontia and pharmacy expenses.

The Navia Debit Card – Rather than paying out-of-pocket for qualified FSA expenses, you can use the Navia Debit Card where the card is accepted.

Save Your Receipts – While most of your Navia Debit Card purchases will not require substantiation, we recommend you always save your receipts and documentation.

Health FSA Carryover – Team members may carryover up to $640 of their unused Health FSA balance into the next Plan Year. Team members may use this carryover balance for claims incurred during the next Plan Year (in addition to any newly elected FSA contributions). Balances above the $640 carryover amount that are remaining from the prior Plan Year and not used to reimburse prior Plan Year expenses are forfeited. You may continue to submit claims for eligible Health FSA expenses for the current plan year during the claim run out period. For full details regarding the provisions of our plan, please review the Summary Plan Description available online.

Dependent Care FSA

The Dependent Care FSA lets team members use pre-tax dollars toward qualified dependent care such as caring for children under the age of 13 or caring for elders.

The Plan Year maximum amount you may contribute to the Dependent Care FSA is $5,000 (or $2,500 if married and filing separately) per calendar year.

For a detailed listing of IRS-approved medical care and dependent care expenses please visit: naviabenefits.com

If you have questions regarding the enrollment process, or for questions regarding your specific benefits, contact a Benefits Advocate at (877) 536-8693 or pdsbenefits@aon.com, M-F 6:00 am to 4:00 pm PT.

Important Notice: This site provides information about the benefits and coverages that are available across the benefit plans maintained by PDS Health (“PDS®”) and by its PDS Supported Entities. This site applies to all team members. The term “team member” in this site refers to you, whether your employer is PDS® or a PDS Supported Entity. When the term “plan” or “Plan” is used in this site, it refers to the benefit plans that each employer makes available to its team members.

This site provides a general description of your employer’s benefits, and it serves as a summary of material modifications to the ERISA-required Summary Plan Descriptions applicable to these benefits (e.g., benefit booklet or evidence of coverage). This site does not describe all terms and conditions that may apply to your benefits. Details, including terms, limitations, and other conditions are provided in the ERISA plan document. If the information in this site differs from the ERISA plan document or Summary Plan Descriptions, then the ERISA plan document and Summary Plan Descriptions should prevail, as applicable.

(800) 669-3539

(800) 669-3539