Team members enrolled in the Anthem HDHP with HSA or the Anthem EPO with HSA medical plan have the option to participate in a Health Savings Account (HSA). The HSA, administered by HealthEquity, is a personal savings account that you can use to pay out-of-pocket healthcare expenses, now and in the future, with pre-tax dollars. And you can receive money from PDS Health or its supported offices by simply opening a HSA.

What is a Health Savings Account (HSA)?

A HSA is a tax-advantaged savings account you can set-up and use to pay for qualified medical, dental, vision, prescription medication and orthodontia expenses not covered by an insurance plan. You pay no taxes on your contributions and withdrawals for qualified medical expenses are tax-free as well as earnings on your investments. Please note that taxes may apply to your contributions and earnings in some states (e.g. California and New Jersey).

A HSA provides you with additional flexibility to manage your healthcare expenses. You own and administer your HSA. You determine how much you will contribute to your account, up to the IRS limits, when to use your money to pay for qualified medical expenses, and when to reimburse yourself. HSAs allow you to save and roll over money if you do not spend it during the plan year. This is similar to a bank account – you must have money in the account before you can spend it. The money in this account is always yours. If you change health plans or jobs, the money remains in your account for future healthcare expenses.

HSA Contribution by PDS Health

PDS Health and its supported offices get you started by contributing to your HSA with semi-annual deposits (January and July, you must be actively employed on this date to receive the deposit). PDS Health semi-annual contributions into your HSA account vary based on whether you cover dependents and on your tobacco usage.

HSA funding and limits

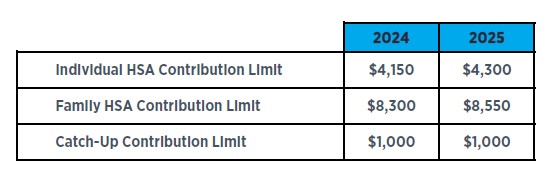

In addition to the contributions PDS Health and/or its supported offices make into your HSA, you choose how much more you’d like to save in your HSA each year by electing automatic pre-tax contributions made from your paycheck. You can change your contribution at any time throughout the year. Money may be contributed to your HSA as long as the total doesn’t exceed the 2024 IRS annual maximum. Team members are responsible for tracking annual limits. Funding limits include both employer and team members contributions.

You are allowed to contribute the entire year’s limit when you first become eligible for the HSA (even if that is in December); however, you must remain eligible for at least 12 months after that date, or you will be subject to taxes and penalties on the amount you contributed.

Medicare and Your HSA

Once you enroll in Medicare, you are no longer eligible to contribute funds to a Health Savings Account (HSA). However, you can use existing money in a HSA to pay for some Medicare costs. It’s important to note that you may receive a tax penalty on any money you contribute to a HSA once you enroll in Medicare.

For more information on the rules and implications of HSA’s after age 65, please consult a qualified tax professional or visit the official Medicare website.

*Health Equity, handles the administration for you. PDS Health and/or its supported offices pay the account set-up and monthly maintenance fees. This means the money funded into your HSA goes further. If you transfer to a non-HSA eligible plan, fees become your responsibility. If you transfer your HSA to another provider, you will be responsible for set-up and maintenance fees.

(866) 346-5800

(866) 346-5800

Open a Health Savings Account (HSA) with HealthEquity and discover the best way to save for health care, and a great way to save on taxes.*

*HealthEquity, handles the administration for you. PDS Health and/or its supported offices pay the account set-up and monthly maintenance fees. This means the money funded into your HSA goes further. If you transfer to a non-HSA eligible plan, fees become your responsibility. If you transfer your HSA to another provider, you will be responsible for set-up and maintenance fees.

Anyone meeting the following requirements is eligible for a HSA:

- You must be covered by a qualified HSA medical plan

- You are not covered by another health plan that is not HSA compatible (ex. spouse’s medical plan)

- You do not have any funds in your or your spouse’s general Healthcare FSA

- You are not enrolled in Medicare, Medicaid, or TRICARE

- You cannot be claimed as a dependent on someone else’s tax return

- You have not received Veterans Administration benefits in the past three months

For more information, contact Health Equity at (866) 346-5800.

If you have questions regarding the enrollment process, or for questions regarding your specific benefits, contact a Benefits Advocate at (877) 536-8693 or pdsbenefits@aon.com, M-F 6:00 am to 4:00 pm PT.

Important Notice: This site provides information about the benefits and coverages that are available across the benefit plans maintained by PDS Health (“PDS®”) and by its PDS Supported Entities. This site applies to all team members. The term “team member” in this site refers to you, whether your employer is PDS® or a PDS Supported Entity. When the term “plan” or “Plan” is used in this site, it refers to the benefit plans that each employer makes available to its team members.

This site provides a general description of your employer’s benefits, and it serves as a summary of material modifications to the ERISA-required Summary Plan Descriptions applicable to these benefits (e.g., benefit booklet or evidence of coverage). This site does not describe all terms and conditions that may apply to your benefits. Details, including terms, limitations, and other conditions are provided in the ERISA plan document. If the information in this site differs from the ERISA plan document or Summary Plan Descriptions, then the ERISA plan document and Summary Plan Descriptions should prevail, as applicable.